Printer Friendly Version

Printer Friendly Version Printer Friendly Version

Printer Friendly Version| 42.4.101 | DETERMINATION OF APPROPRIATE SYSTEMS |

This rule has been repealed.

| 42.4.102 | INCOME TAX CREDIT FOR NONFOSSIL ENERGY GENERATION SYSTEM |

This rule has been repealed.

| 42.4.103 | PROPERTY TAX EXEMPTION FOR NONFOSSIL ENERGY SYSTEM |

This rule has been transferred.

| 42.4.104 | ENERGY GENERATING SYSTEMS |

(1) Various tax benefits are allowed for investments in "recognized nonfossil forms of energy generation." The term "recognized nonfossil forms of energy generation" is defined in 15-32-102, MCA, and ARM 42.4.110. The term does not include commercial systems, which may be eligible for a separate credit as described in subchapter 41 of this chapter. In this rule, the term "alternative energy generating systems" is used generically to describe all of the recognized nonfossil forms of energy generation listed in ARM 42.4.110.

(2) The tax benefits for installing an alternative energy generating system are:

(a) a credit against their individual income tax liability to resident individuals who install the generating system to provide energy for their principal dwelling (equal to the cost of the system, including installation costs, less grants received, not to exceed $500) as provided in 15-32-201, MCA;

(b) if the system uses a "low emission wood or biomass combustion device" as defined in 15-32-102, MCA, and ARM 42.4.110, that a resident individual installs to provide heat for their principal dwelling, a credit against their individual income tax equal to the cost of the system, including installation, not to exceed $500, as provided in 15-32-201, MCA;

(c) if the energy generating system is a geothermal system that transfers energy from the ground by way of a closed loop or from ground water by way of an open loop that a resident individual installs in their principal dwelling to heat or cool the dwelling, a credit against their individual income tax equal to a portion of the installation costs of the system, not to exceed $1,500, as provided in 15-32-115, MCA;

(d) if the energy generating system is a geothermal system described in (2)(c), that is installed by a builder constructing a new residence to heat or cool the dwelling, a credit against the builder's individual or corporate income tax liability, as applicable, equal to a portion of the installation costs of the system, not to exceed $1,500, as provided in 15-32-115, MCA;

(e) a property tax exemption for a portion of the appraised value of a capital investment in the alternative energy generating system for ten years after installation, as described in 15-6-224, MCA, and ARM 42.19.1104 (the system may be installed in a residential dwelling or a commercial structure); and

(f) a property tax exemption for machinery and equipment used in qualifying small electric generating systems that are powered by an alternative renewable energy source, as described in 15-6-225, MCA, and ARM 42.4.4105.

(3) A taxpayer "completes installation of an energy system using a recognized nonfossil form of energy generation" as outlined in 15-32-201, MCA, when the following components of a system have been installed and placed in service:

(a) a source of alternative energy production, such as:

(i) solar photovoltaic modules;

(ii) solar thermal collectors;

(iii) a wind turbine;

(iv) a hydropower turbine; or

(v) a geothermal ground loop;

(b) a point of interconnection to the dwelling's electrical, heating, or hot water system; and

(c) if the source of alternative energy production does not produce energy in a usable form, a means of converting energy to a usable form, such as:

(i) for electrical energy systems, an inverter; or

(ii) for thermal energy systems, a heat exchanger.

(4) The cost for repair or replacement of a component installed in an existing system is not eligible for the credit.

(5) The cost of additional components installed to expand the output of an existing system is eligible for the credit. For example, if a taxpayer expands their solar photovoltaic energy system from one module to four modules, the energy credit is only available for the three new components, not all four.

(6) Energy generating systems that are standard components of conventional structures do not qualify for the property tax exemption provided in 15-6-224, MCA, or the alternative energy system credit provided in 15-32-201, MCA. ARM 42.4.110 defines standard components.

(7) To qualify for the property tax exemption provided in 15-6-224, MCA, or the alternative energy system credit provided in 15-32-201, the predominant use of the alternative energy system must be energy generation. The predominant use of a system is not energy generating if it possesses any two of the following characteristics:

(a) it is a structure that will be occupied more than four hours in a day;

(b) it is a structure that serves as a regularly used entry way to the building for which it provides energy;

(c) it is a structure that receives heat from a source other than the energy it generates;

(d) it is a structure that contains more space than is reasonably necessary for energy collection, generation, and distribution (about 200 to 230 sq. ft. to provide heat to a building with at least 1,000 sq. ft. of living area); or

(e) it is part of the living area of the structure for which it provides energy.

(8) Meeting the minimum system standards imposed to obtain a federal tax credit for solar energy systems, including solar water heating and photovoltaic systems, or for geothermal, wind energy, or fuel cell systems, is not a condition of qualifying for the Montana alternative energy system or geothermal system credits.

(9) The credits against individual income tax liability described in (2)(a) and (2)(b) are claimed on Form ENRG-B, Alternative Energy System Credit. The credits for the geothermal systems described in (2)(c) and (2)(d) are claimed on Form ENRG-A, Geothermal System Credit.

| 42.4.105 | STANDARD COMPONENTS AND PASSIVE SOLAR SYSTEMS |

(1) Energy generating systems or their components that are standard components of conventional buildings do not qualify for the alternative energy system credit. The department is authorized to adopt rules defining standard components of conventional buildings and to establish other necessary elements of passive solar systems.

(2) Passive solar energy systems, or the components of those systems that have been determined to be acceptable include:

(a) solar greenhouses, sun porches, and like structures that are properly situated, constructed, and ducted to the building for which they provide energy to be reasonably considered a complete or supplementary energy source for that building;

(b) components of a building that have been altered for energy collection, storage, or distribution to benefit the rest of the building, such as the addition of triple glazed windows to enclosed porches;

(c) windows installed in excess of "double-glazing;"

(d) thermal collection masses such as brick, stonework, and other types that were not present in the original structure and were not installed for a purpose other than energy storage; and

(e) the components of an envelope house necessary for energy generation and distribution in the "envelope house," such as the "envelope" area devoted solely to energy collection, storage, and distribution.

| 42.4.106 | OTHER ENERGY GENERATING SYSTEMS |

This rule has been repealed.

| 42.4.107 | ELECTRICAL GENERATION AND TRANSMISSION FACILITY – QUALIFICATION AND PUBLICATION |

This rule has been transferred.

| 42.4.108 | ELECTRICAL GENERATION AND TRANSMISSION FACILITY – REPORTING |

This rule has been transferred.

| 42.4.109 | ELECTRICAL GENERATION AND TRANSMISSION FACILITY – VERIFICATION |

This rule has been transferred.

| 42.4.110 | DEFINITIONS |

The following definitions apply to terms used in this subchapter:

(1) "EPA" means the United States Environmental Protection Agency.

(2) "Low emission wood or biomass devise" means:

(a) a wood-burning appliance certified as meeting EPA standards of performance for new residential wood heaters in 40 C.F.R. 60.533;

(b) a wood-burning out-door hydronic heater that qualifies for the EPA's phase 2 white tag (meets the EPA's Phase 2 emission levels) under EPA test method 28 OWHH;

(c) a masonry heater constructed or installed in compliance with the requirements for masonry heaters in the International Residential Code of One- and Two-Family Dwellings; and

(d) an appliance that uses wood pellets as its primary source of fuel, regardless of the level of emissions.

(3) "Passive solar system" is defined in 15-32-203, MCA, and means a direct thermal energy system that uses the structure of the building and its operable components to provide heating or cooling during the appropriate times of the year by using the climate resources available at site.

(4) "Principal dwelling" means an individual's main home and excludes second homes, vacation or recreational property, and rentals.

(5) "Recognized nonfossil forms of energy generation" is defined in 15-32-102, MCA, and means:

(a) a system that captures energy for use or converts energy into usable sources using:

(i) solar energy (including a passive solar system);

(ii) wind;

(iii) solid waste;

(iv) decomposition of organic wastes;

(v) geothermal;

(vi) fuel cells that do not require hydrocarbon fuel;

(vii) a low emission wood or biomass device; and

(viii) small hydropower plants under one megawatt;

(b) a system that produces electric power from biomass or solid wood wastes; and

(c) a system that uses water power by means of an impoundment that is not over 20 acres in surface area.

(6) "Standard components of conventional structures" are those structures that are generally necessary for structural support, shelter, ventilation, temperature control, lighting, or maintenance of the occupant's regular life style.

| 42.4.111 | ALTERNATE RENEWABLE ENERGY GENERATION FACILITIES EXEMPTION - LESS THAN ONE MEGAWATT |

This rule has been transferred.

| 42.4.112 | APPEAL RIGHTS |

This rule has been transferred.

| 42.4.113 | COMMERCIAL USE FOR INCOME TAX |

This rule has been transferred.

| 42.4.114 | PROPERTY TAX EXEMPTION - NONCOMMERCIAL ELECTRICAL GENERATION MACHINERY AND EQUIPMENT |

This rule has been transferred.

| 42.4.115 | WIND ENERGY TAX CREDITS FOR GENERATION FACILITIES LOCATED IN EXTERIOR BOUNDARIES OF A MONTANA INDIAN RESERVATION - TRIBAL EMPLOYMENT AGREEMENT |

This rule has been transferred.

| 42.4.116 | WIND ENERGY TAX CREDITS FOR GENERATION FACILITIES LOCATED ON SCHOOL TRUST LAND |

This rule has been transferred.

| 42.4.117 | DEDUCTIBILITY OF IMPACT FEE FOR LOCAL GOVERNMENT AND SCHOOL DISTRICTS |

This rule has been transferred.

| 42.4.118 | MULTIPLE INVESTORS CLAIMING THE ALTERNATIVE ENERGY SYSTEM |

(1) If more than one qualifying individual invests in a qualifying alternative energy system each may claim the credit provided the total of the credits claimed by all the individuals does not exceed the amount spent. For example, if a married couple invests $1,200 in a qualifying wood stove, they can each claim $500. However, if the same couple invests only $800 in a qualifying wood stove, the combined amount claimed cannot exceed $800.

| 42.4.119 | RECORDS REQUIRED - AUDIT |

This rule has been transferred.

| 42.4.120 | REQUEST FOR INFORMATION |

This rule has been transferred.

| 42.4.121 | INDIVIDUAL ENERGY-RELATED TAX BENEFITS |

This rule has been repealed.

| 42.4.130 | DEDUCTION OR CREDIT FOR INVESTMENT FOR ENERGY CONSERVATION |

This rule has been transferred.

| 42.4.131 | DETERMINATION OF CAPITAL INVESTMENT FOR ENERGY CONSERVATION |

This rule has been transferred.

| 42.4.201 | DEFINITIONS |

This rule has been repealed.

| 42.4.202 | INDIVIDUAL INCOME TAX CREDIT FOR ENERGY CONSERVING EXPENDITURES |

This rule has been repealed.

| 42.4.203 | CREDIT FOR ENERGY CONSERVATION INVESTMENT |

This rule has been repealed.

| 42.4.204 | CAPITAL INVESTMENTS FOR QUALIFYING ENERGY CONSERVATION CREDIT |

This rule has been repealed.

| 42.4.205 | TAX YEAR FOR CLAIMING THE ENERGY CONSERVATION CREDIT AND MULTIPLE UNITS OR INVESTORS |

This rule has been repealed.

| 42.4.206 | NEW CONSTRUCTION STANDARDS |

This rule has been repealed.

| 42.4.207 | RECORD RETENTION REQUIREMENTS |

This rule has been repealed.

| 42.4.208 | ANNUAL UPDATE OF CAPITAL INVESTMENTS QUALIFYING FOR THE ENERGY CONSERVATION CREDIT |

This rule has been repealed.

| 42.4.209 | STANDARDS AND RATINGS |

This rule has been repealed.

| 42.4.301 | DEFINITIONS |

The following definitions apply to this subchapter:

(1) "Amenities" are items that enhance the pleasantness or desirability of rental or retirement homes, or contribute to the pleasure and enjoyment of the occupant(s), rather than to their indispensable needs. For periods beginning after December 31, 2016, "amenities" means services unrelated to the occupation of a dwelling and provided by personnel, including but not limited to meals, housekeeping, transportation, assisted living, or nursing care.

(2) "Gross household income" as defined under 15-30-2337, MCA, is further defined as:

(a) all capital gains income transactions less return of capital;

(b) federal refundable credits received; and

(c) any state refundable credits received, including elderly homeowner/renter credit refunds.

(3) "Land surrounding the eligible residence for the elderly homeowner/renter credit" is the one-acre farmstead or primary acre associated with the primary residence.

(a) If the one-acre farmstead or primary acre is not separately identified on the tax bill or assessment notice from the other acreage and the ownership is less than 20 acres, the allowable credit shall be calculated as follows: total amount of property tax billed, multiplied by 80 percent or divided by the total acreage, whichever is higher, to equal the allowable amount of property tax used in the credit calculation.

(b) Land ownership of 20 acres or more that does not have the one-acre farmstead or primary acre separately identified on the tax bill or assessment notice must be submitted to the department's local office for computation of the allowable amount of property tax used in the credit calculation.

(4) "Rent" is the amount of money charged to a tenant to occupy a dwelling. "Rent" does not include amenities.

| 42.4.302 | COMPUTATION OF ELDERLY HOMEOWNER/RENTER TAX CREDIT |

(1) When the taxpayer owns the dwelling but rents the land or owns the land and rents the dwelling, the taxpayer shall add the rent-equivalent tax paid on the rented property to the property tax billed on the owned property. The total shall then be reduced as provided by 15-30-2340, MCA. The tax credit will be the reduced amount or $1,000, whichever is less.

(2) To calculate the credit, an eligible claimant is allowed to use property taxes billed:

(a) on property held in a revocable trust if the grantor(s) of the property or their spouse is the claimant and are trustees of the revocable trust;

(b) as rent if the property occupied by the claimant is in a name other than the claimant; or

(c) if the claimant has a living trust or a life estate.

(3) When a taxpayer lives in a health, long-term, or residential care facility (facility), as defined in 50-5-101, MCA, the rent allowed in calculation of the property tax credit is the actual out-of-pocket rent paid.

(a) If one spouse lives in a facility and the other lives at a different address, they are allowed to report either the rent paid for the facility or the rent/property taxes billed for the other address, but not both. Married taxpayers who are living apart are entitled to file and receive only one claim per year.

(b) Prior to January 1, 2017, if a claimant lived in a facility that did not provide an adequate breakdown between "rent" and "amenities" paid, the rent allowed is limited to:

(i) $20 a day for periods beginning on or before December 31, 2014; or

(ii) $30 a day for periods beginning after December 31, 2014.

(c) For claims for periods beginning after December 31, 2016, if a claimant lives in a facility, the out-of-pocket rent being claimed must exclude payments for amenities. To satisfy this obligation, the claimant must either:

(i) utilize a detailed statement provided by the facility itemizing the amount paid for rent and the amount paid for amenities separately; or

(ii) determine the amount of allowable rent by deducting the amenities from the total amount paid as follows:

(A) 20 percent for services related to board such as meals, housekeeping, laundry, and transportation;

(B) 30 percent for services related to continuous care such as assisted living, medical care, paramedical care, memory care, medical supplies, and pharmacy; or

(C) 50 percent if the services in both (A) and (B) are provided.

(d) Examples of calculating the allowable rent in (c) are as follows:

(i) Val rents a room in an independent living facility. Her $1,000 monthly payment includes utilities and parking, but no services delivered by personnel. No calculation is needed. Val is allowed to report the full $1,000 per month as rent.

(ii) Paul rents a room in an independent living facility. In addition to utilities and cable, his $2,500 monthly payment includes board such as housekeeping, meals, and transportation provided by staff and contractors. The facility's year-end statement does not break out his total paid. Paul deducts 20 percent ($2,500 - 20%) for the board services to calculate $2,000 per month as allowable rent to report.

(iii) Ron lives in a long-term care facility and receives board services, assistance with daily living activities, and special memory care. The facility's year-end statement partially breaks out his $40,000 total payment, showing the amount charged by a contractor for his memory care. It does not list the amounts charged for board and care provided by staff. Ron deducts 50 percent ($40,000 - 50%) for board (20%) and care (30%) to calculate $20,000 as allowable rent to report for the year.

(iv) George rents an apartment in an assisted living facility. The facility's year-end statement breaks out his $30,000 total payment as $14,400 for rent, $5,000 for board, and $10,600 for care. George may report the $14,400 stated rent amount or, alternately, choose to deduct 50 percent from the total ($30,000 - 50%) for board (20%) and care (30%) to calculate $15,000 as allowable rent to report for the year.

(v) Mary rents a room in an assisted living facility for six months while recovering from a medical procedure. Her $2,000 total monthly payment includes assistance with daily living activities provided by staff, but she chose not to receive any additional services such as board. The facility does not itemize her payment. Mary deducts 30 percent from the monthly payment ($2,000 - 30%) for the care to calculate $1,400 per month in allowable rent. Mary may report either the allowable rent paid to the facility, or the monthly rent she paid for her primary residence during the same six-month period, but not both.

| 42.4.303 | CLAIMING AN ELDERLY HOMEOWNER/RENTER TAX CREDIT |

(1) The elderly homeowner credit may be claimed by an eligible individual or, if an eligible individual dies before making a claim, by the personal representative of their estate, and must be made on Form 2EC, Montana Elderly Homeowner/Renter Credit.

(2) The time for, and manner of making, a claim for the credit depends on whether or not the qualified individual (or the personal representative for them) files an individual income tax return for the year for which the credit is claimed.

(a) If an eligible individual files or is required to file an individual income tax return for the year for which the credit is claimed, the claim must be filed with the return on or before the due date of the return, including extensions. ARM 42.15.301 sets forth the rules for determining whether an individual is required to file a return. If a return is made by or for an eligible individual without making a claim for the credit, the credit may be claimed by filing an amended return within five years after the due date of the return, not including extensions.

(b) If an eligible individual is not required to file an individual income tax return, no later than April 15th of the fifth year following the claim year the claim must be:

(i) mailed to the department at the address set forth in ARM 42.1.101;

(ii) delivered to:

Department of Revenue

Sam W. Mitchell Building

Third floor, 125 North Roberts

Helena, Montana; or

(iii) filed electronically through the department's web site at: www.revenue.mt.gov.

(c) If an eligible individual is required to, but did not, file an individual income tax return the claim must be made by filing an individual income tax return with completed Form 2EC as provided in (2)(a).

(d) If the taxpayer claiming the credit files their tax return electronically, he or she represents that they have completed Form 2EC and have all the required documentation. The form and required documentation are tax records the taxpayer must retain and provide to the department on request.

(3) The following are examples showing how this rule is applied:

(a) Taxpayer is required to file an individual income tax return for 2011 and, although eligible, neglects to claim the credit by filing Form 2EC with their 2011 individual income tax return which they file April 6, 2012. Taxpayer may claim the credit by filing an amended 2011 individual income return with completed Form 2EC on or before April 15, 2017.

(b) Taxpayer, who is not required to file an individual income tax return for 2011, dies in February 2012. The taxpayer's personal representative, appointed June 2012, may at any time before April 15, 2017, either file a 2011 individual income tax return for the taxpayer with completed Form 2EC or file Form 2EC without filing a 2011 return.

(c) Taxpayer is required to, but does not file an individual income tax return for 2012. Taxpayer or, if the taxpayer has died, the personal representative of the taxpayer's estate, may claim the credit by filing a 2012 individual income return with completed Form 2EC on or before April 15, 2018.

| 42.4.401 | DEFINITIONS |

The following definitions apply to this subchapter:

(1) "Another state" or "other state" means a state of the United States other than Montana, the District of Columbia, the Commonwealth of Puerto Rico, any other territory or possession of the United States, and a foreign country.

(2) "Foreign income tax" means the income tax paid to another state for which the credit described in ARM 42.4.402 is claimed.

(3) "Income tax" means a tax measured by and imposed on net income and, in the case of an S corporation and partnership, includes an excise tax or franchise tax that is imposed on, and measured by, the net income of the S corporation or partnership. The term does not include any other taxes such as, but not limited to, franchise or license taxes or fees not measured by net income, gross receipts taxes, gross sales taxes, capital stock taxes, or property, transaction, sales, or consumption taxes. The term does not include penalty or interest paid in connection with an income tax.

(4) "Taxable foreign income" means the income from the other state that is included in the taxpayer's Montana adjusted gross income.

(5) "Total foreign income" means the income of the other state upon which the foreign income tax was computed.

| 42.4.402 | CREDIT FOR INCOME TAXES PAID TO ANOTHER STATE OR COUNTRY |

(1) A Montana resident is allowed a nonrefundable credit against the resident's Montana income tax liability for:

(a) income taxes they paid to another state or foreign country on income which is also subject to Montana income tax;

(b) the resident shareholder's pro rata share of income taxes paid by an S corporation to another state or foreign country on income that is subject to Montana income tax as provided in Title 15, chapter 30, MCA; and

(c) the resident partners' distributive share of income taxes paid by a partnership to another state or foreign country on income that is subject to Montana income tax as provided in Title 15, chapter 30, MCA.

(2) The credit is allowed under the following conditions and limitations:

(a) the credit is allowed only with respect to an income tax imposed by law and actually paid. An income tax is a tax measured by and imposed on net income and, in the case of an S corporation or partnership, includes an excise tax or franchise tax that is imposed on and measured by the net income of the entity. The credit is not allowed for other taxes such as, but not limited to, franchise or license taxes or fees not measured by net income, gross receipts taxes, gross sales taxes, capital stock taxes, or property, transaction, sales, or consumption taxes. The credit is not allowed for penalty or interest paid in connection with an income tax;

(b) in the case of a taxpayer who either becomes or ceases to be a Montana resident during the taxable year, the credit is allowed only with respect to income earned during the fractional part of the year the taxpayer was a resident of this state;

(c) the credit is allowed only with respect to an income tax that the taxpayer does not claim as a deduction in determining Montana taxable income;

(d) the credit is allowed only if the state or foreign country imposing the income tax liability does not allow the taxpayer a credit for Montana income tax liability incurred with respect to the income derived within such state or foreign country; and

(e) the credit is allowed for taxes paid to a foreign country only to the extent the taxes paid exceed either:

(i) the amount claimed under IRC section 904(a) plus any carryback and carryover amount allowed under IRC section 904(c); or

(ii) the amount claimed under IRC section 904(k).

(3) The credit against income taxes is claimed on the Montana tax return for the same year that the taxpayer reports the income associated with the tax paid to the other state or country. Because the Montana credit is nonrefundable and any unused credit may not be used in another tax year, taxes that for federal income tax purposes are deemed paid or accrued in a carryback or carryover year must be removed before calculating the Montana foreign tax credit.

(4) The credit cannot be claimed by an individual for taxes paid to another state or country by an estate or trust.

(5) If a taxpayer amends the amount of income reported to the other state or a foreign country on which the Montana credit was based, the taxpayer shall file an amended Montana tax return to recalculate the credit allowed.

| 42.4.403 | COMPUTATION OF CREDIT FOR TAX PAID TO ANOTHER STATE OR COUNTRY |

(1) In determining the tax credit allowed, the computations in this rule must be made separately for each state or foreign country's income tax with respect to which a credit is claimed.

(2) If the claim for credit does not include the taxpayer's share of income tax paid to another state or country by an S corporation or partnership in which the taxpayer is a shareholder or partner:

(a) determine the amount of income taxable by the other state or foreign country that is included in Montana adjusted gross income (AGI), but do not include income that is exempt in Montana;

(b) determine the amount of tax paid to the other state or foreign country on income that is not exempt in Montana by multiplying the tax paid to the other state or foreign country by a fraction:

(i) the numerator of which is the amount of income taxable by the other state or foreign country that is included in Montana AGI (excluding income exempt in Montana;) and

(ii) the denominator of which is the total amount of income taxable by the other state or foreign country (including income exempt in Montana).

(c) determine the proportionate amount of the Montana income tax attributable to income taxed by the other state or foreign country by multiplying the Montana income tax liability, as determined without the credit, by a fraction:

(i) the numerator of which is the taxpayer's income taxable by the other state or foreign country that is included in the taxpayer's Montana AGI; and

(ii) the denominator of which is the taxpayer's total Montana AGI.

(d) the credit allowable is the lower of:

(i) the amount of income tax reported and paid to the other state or foreign country;

(ii) the amount of the income tax reported and paid to the other state or foreign country on income that is not exempt in Montana, the result of the calculation in (2)(b); or

(iii) the proportionate amount of the Montana income tax attributable to income taxed by the other state or foreign country, the result of the calculation in (2)(c).

(3) If the claim for credit does include the taxpayer's share of income tax paid to another state or country by an S corporation or partnership on income that is subject to Montana income tax:

(a) increase the taxpayer's Montana AGI for the tax year the entity deducted the income taxes by the taxpayer's share of the entity's deduction;

(b) calculate the Montana income tax liability taking the increase in Montana AGI into account;

(c) determine the taxpayer's share of the amount of net entity income that is included in Montana AGI (do not include income that is exempt in Montana);

(d) determine the taxpayer's share of the amount of income tax reported and paid to the other state or foreign country by the entity on income that is not exempt in Montana by multiplying the share of the amount of tax reported and paid to the other state or foreign country by the entity by a fraction:

(i) the numerator of which is the share of the amount of the entity's net income included in the Montana AGI (excluding income exempt in Montana); and

(ii) the denominator of which is the share of the total amount of the entity's net income (including income exempt in Montana).

(e) multiply the recalculated Montana income tax liability by a fraction, the numerator of which is the taxpayer's share of income of the entity included in the taxpayer's Montana AGI, adjusted as provided in (3)(a), and the denominator of which is the taxpayer's total Montana AGI, adjusted as provided in (3)(a);

(f) the credit allowable is the lower of:

(i) the share of the amount of income tax reported and paid by the entity to the other state or foreign country;

(ii) the share of the amount of the income tax reported and paid to the other state or foreign country by the entity on the share of income that is not exempt in Montana, the result of the calculation in (3)(d); or

(iii) the proportionate amount of the Montana income tax attributable to the share of income of the entity reported to the other state or foreign country, the result of the calculation in (3)(e).

(4) Examples of how to calculate these credits paid to another state or country are outlined in (a) through (c):

(a) Example 1 - Taxpayer, a full-year Montana resident, sold real property in State X in 2017. State X does not provide nonresidents a credit for income earned in that state if that income is taxable in another state. In 2018, the taxpayer was legally required to, and did, file a 2017 State X income tax return reporting the transaction and paying State X an income tax of $700. The taxpayer's $5,000 gain on the sale of the State X property was included in the taxable income reported on the 2017 Montana income tax return. The taxpayer's 2017 Montana income tax liability was $3,400. The taxpayer's total 2017 Montana AGI was $23,000, which included the $5,000 gain on the sale of property in State X. The amount of credit the taxpayer may claim against the 2017 Montana income tax liability is $700, the smaller of the amounts in (i) through (iii):

(i) The amount of income tax paid to State X is $700;

(ii) The amount of income tax paid to State X on income that is not exempt in Montana is $700. This amount is determined by multiplying the tax paid to State X ($700) by a fraction, the numerator of which is the amount of income from State X that is included in Montana AGI ($5,000), and the denominator of which is the total amount of income from State X, including any income that is exempt in Montana. The calculation is $700 x ($5,000/$5,000) = $700;

(iii) The proportionate amount of the Montana income tax attributable to income taxed by State X is $739. This amount is determined by multiplying the Montana income tax liability without the credit ($3,400) by a fraction, the numerator of which is the income from State X included in Montana AGI ($5,000), and the denominator of which is total Montana AGI ($23,000). The calculation is $3,400 x ($5,000/$23,000) = $739.

(b) Example 2 - Taxpayer, a full-year Montana resident, was a shareholder in an S corporation that was engaged in banking in State X in 2017. State X does not allow S corporations engaged in financial businesses to elect state-level S corporation treatment and imposes a tax on them measured by net income. The following represents what occurred:

(i) The S corporation was required to and did file a 2017 income tax return with State X in 2018 and paid a tax measured by its net income of $132,000, $121,000 by estimated payments made in 2017 and the balance of $11,000 in 2018 when it filed its 2017 return;

(ii) The S corporation paid $15,000 tax to State X for tax year 2016 when it filed its 2016 return in 2017. The S corporation's non-separately stated and separately stated items for tax year 2017 were as follows, of which the Montana resident shareholder's share was 10 percent:

(A) An ordinary income of $2,000,000 from banking business includes a deduction of $136,000 for State X taxes paid in 2017, $121,000 for estimated payments in 2017, and $15,000 for 2016 taxes paid in 2017;

Tax exempt interest income $1,200,000

Ordinary dividends 300,000

(B) The taxpayer's total 2017 Montana AGI was $500,000, which included 10 percent of the S corporation's ordinary dividends, or $30,000, and 10 percent of the ordinary income from its banking business, or $200,000;

(C) The shareholder's $200,000 share of the S corporation's ordinary income from its business was reduced by the shareholder's share of the S corporation's deduction for $136,000 income taxes paid to State X in 2017, or by $13,600 (had the shareholder paid the shareholder's 10 percent share of the State X's taxes rather than the S corporation, the shareholder's 10 percent pro rata share of the S corporation's ordinary income for 2017 would have been $213,600);

(D) The shareholder's 10 percent share of the S corporation's tax-exempt interest, or $120,000, is exempt from Montana individual income tax but is subject to tax by State X; and

(E) Assume the taxpayer's 2017 Montana tax liability would be $50,000 if the credit were not claimed;

(iii) The taxpayer calculates the Montana income tax liability and the amount of credit the taxpayer may claim against the 2017 income tax liability as follows:

(A) The taxpayer's Montana taxable income is increased by the pro rata share of the S corporation's deduction for State X taxes paid for which the taxpayer claims the credit;

Montana AGI: $500,000

Reverse deduction: 13,600

Adjusted MT AGI: $513,600

(B) The taxpayer's pro rata share of the tax reported and paid to State X by the S corporation for 2017 ($13,200) is multiplied by the proportion of the taxpayer's pro rata share of the S corporation income taxed in State X that is not exempt in Montana ($230,000) to the taxpayer's pro rata share of the amount of income that is taxable in State X, including income that is exempt in Montana ($350,000):

Ordinary income from banking operations $200,000

Ordinary dividends 30,000

S corporation income exempt from Montana tax 120,000

Taxpayer's share of income tax reported and paid to State X on income that is not exempt in Montana:

$13,200 x $230,000 / $350,000 = $8,674

(C) The taxpayer's Montana income tax liability is recalculated. Tax on adjusted Montana AGI of $513,600: $56,500 (assumed result). The recalculated Montana income tax liability ($56,500) is multiplied by the ratio of S corporation net income included in Montana AGI, increased by the pro rata share of the S corporation deduction for the income taxes paid ($200,000 + $30,000 + $13,600 = $243,600) to the taxpayer's total Montana AGI, increased by the pro rata share of the S corporation deduction for income taxes paid ($513,600).

Montana income tax attributable to income that is taxed in both states:

$56,500 x $243,600 / $513,600 = $26,798

(D) The allowable credit is $8,674, the lower of:

(I) pro rata share of the income tax reported and paid by the S corporation, $13,200;

(II) pro rata share of the amount of the income tax reported and paid to the other state or foreign country by the S corporation on their pro rata share of income that is not exempt in Montana, $8,674; and

(III) proportionate amount of the Montana income tax attributable to their pro rata share of income of the S corporation reported to the other state or foreign country, $26,798.

(c) Example 3 – A full-year Montana resident pays $1,000 in income taxes to a foreign country. For federal income tax purposes, the taxpayer elects to claim the federal foreign credit for those taxes rather than a deduction. The amount of the foreign federal tax credit is $800, $500 of which the taxpayer claims currently and $300 of which is allowed to be carried back and forward under IRS 904(c). In calculating the Montana credit for taxes paid to the foreign country, the taxpayer must use $200 rather than $1,000 as the amount of taxes paid to the foreign country.

| 42.4.404 | DEDUCTIONS NOT ALLOWED WHEN CREDIT CLAIMED |

(1) Except as provided in (2), a taxpayer may not claim a deduction for any item for which a credit is claimed.

(2) The total amount of wages and salaries paid may be claimed as a deduction by a taxpayer who, in determining federal AGI, has reduced the taxpayer's business deductions by the amount of wages and salaries for which a federal work opportunity tax credit was elected under sections 38 and 51(a) of the IRC.

| 42.4.501 | DEFINITIONS |

The following definitions apply to terms found in this subchapter:

(1) "Net capital gain" means an individual's net capital gain included in Montana adjusted gross income as shown on their Montana individual income tax return.

(2) "Tax year 2005" means the taxpayer's tax year beginning after December 31, 2004.

(3) "Tax year 2006" means the taxpayer's tax year beginning after December 31, 2005.

| 42.4.502 | CAPITAL GAIN CREDIT |

(1) An individual may claim a credit against their Montana individual income tax of up to 2 percent of their net capital gain. The credit is based on the net capital gain as shown on the individual's Montana individual income tax return. Spouses who file a joint return for federal income tax purposes but a separate return for Montana income tax and who elect to claim the same amount of capital loss deduction as shown on their joint federal income tax return as provided in 15-30-2110, MCA, must compute the capital gain credit consistently. The credit is nonrefundable and may not be carried back or carried forward to any other tax year. The credit must be applied before any other credit.

(2) A nonresident or a part-year resident must apply the credit to Montana tax computed as if he or she were a resident during the entire tax year.

(3) For an estate or trust filing a Form FID-3, Montana fiduciary return, the credit is calculated on the net capital gains reported minus any net capital gains distributed to any beneficiary.

(4) Married taxpayers filing separately must compute and report their capital gains and losses as provided in ARM 42.15.206.

(5) Spouses may elect to report all of their capital gains and losses separately for the current and future tax years. An election is made by claiming a capital gains credit calculated on a net capital gain amount that is different from the net capital gain shown on the taxpayer's joint federal income tax return, or claiming a capital loss deduction that is greater than the amount that would be allowed for federal income tax purposes if the taxpayer had filed a separate federal income tax return.

(6) The following are examples of how the credit is applied:

(a) Example: For tax year 2017, John and Barbara file a joint 2017 federal income tax return reporting $2,000 of net capital gain. John's income consists of $50,000 in wages and $8,000 of net capital gain. Barbara's income consists of $35,000 in wages and $6,000 of net capital loss. If they file separately rather than jointly for Montana, unless they elect to separately report their capital gains and losses for this and future years as provided in (5), their capital gain credit is 2 percent of their net capital gain of $2,000, or $40.

(b) Example: Assume the same facts as the example in (a) except that the spouses do elect to separately report their capital gains and losses as provided in (5). John may claim a capital gain credit of up to $160 ($8,000 x 2%) against his Montana income tax. Barbara is not entitled to claim any credit against her tax.

|

| Federal Return | Montana Return | |

|

|

| Column A | Column B |

| Wages | $85,000 | $50,000 | $35,000 |

| Sch. D capital gain (loss) | $ 2,000 | $ 8,000 | $(6,000) |

| Fed. adjusted gross income | $87,000 | $58,000 | $32,000 |

| Montana adjustment for capital loss limit |

|

|

|

|

|

|

|

|

| Montana adjusted gross income |

|

| $36,500 |

| Montana capital loss carryover | $94,500 | $58,000 | ($4,500) |

| 42.4.601 | DEFINITIONS |

This rule has been repealed.

| 42.4.602 | RURAL PHYSICIAN'S CREDIT -- QUALIFICATIONS -- LIMITATIONS |

This rule has been repealed.

| 42.4.603 | RURAL PHYSICIAN'S CREDIT - REPAYMENT |

This rule has been repealed.

| 42.4.702 | QUALIFYING FOR THE PROPERTY TAX CREDIT UNDER 15-30-2336, MCA |

This rule has been repealed.

| 42.4.703 | CALCULATION OF THE REFUNDABLE INDIVIDUAL INCOME TAX CREDIT UNDER 15-30-2336, MCA |

This rule has been repealed.

| 42.4.801 | DEFINITIONS |

The following definitions apply to terms used in this subchapter:

(1) "School district," for the purposes of this rule, means a Montana public elementary school district or public high school district, or any of the three state-funded public schools: Montana School for the Deaf and Blind, the Department of Corrections – adult school, and the Department of Corrections – youth school.

| 42.4.802 | QUALIFIED EDUCATION PROVIDER |

This rule has been repealed.

| 42.4.803 | SCHOOL DISTRICT AND STUDENT SCHOLARSHIP ORGANIZATION (SSO) REQUIREMENTS AND PREAPPROVAL PROCESS |

(1) Prior to registering a donation with the department, a school district or SSO shall submit a complete application to the department. The application is located on the department's website at the education donations portal. The application must include the following information:

(a) the school district or SSO name, address, and federal employer identification number; and

(b) the school district or SSO donation manager's name, title, phone number, and e-mail address.

(2) A school district or SSO must register each donation, upon receipt, in the department's registration system. Preapproval of the amount of donation eligible for the credit will be provided at the time the school district or SSO registers the donation in the department's registration system.

(3) With respect to the aggregate limit of tax credits allowed for a year, the priority of donations is based upon the time and date stamp issued by the department's registration system when a school district or SSO completes registration of the donation. Donations made in excess of the aggregate limits and credit cap, which is the amount of the credit provided under 15-30-3110 and 15-30-3111, MCA, will not be eligible for the tax credit.

(4) The department will certify to a school district or SSO the amount of credit available to the taxpayer when the school district or SSO completes the registration of the donation in the department's registration system.

| 42.4.804 | CREDIT LIMITATIONS AND CLAIMS |

(1) A taxpayer may claim a credit for contributions made in cash to a school district provided for in 20-9-901, MCA, and/or a student scholarship organization (SSO), provided for in 15-30-3110, MCA. For the purpose of this rule, cash includes:

(a) U.S. currency;

(b) a personal check;

(c) cashier's check;

(d) money order;

(e) bank draft;

(f) an electronic bank account transfer (e.g., wire transfer, ACH draft);

(g) a credit card transaction (less any transaction surcharges or fees); or

(h) traveler's check.

(2) The maximum credit that may be claimed in a tax year by an individual taxpayer or a corporation for allowable contributions to:

(a) a school district is $200,000; and

(b) an SSO is $200,000.

(3) In the case of a married couple that makes a joint contribution, unless specifically allocated by the taxpayers, the contribution will be split equally between each spouse. If each spouse makes a separate contribution, each may be allowed a credit up to the maximum amount.

(4) An allowable contribution from:

(a) an S corporation passes to its shareholders based on their ownership percentage; and

(b) a partnership or limited liability company taxed as a partnership passes to their partners and owners based on their share of profits and losses as reported for Montana income tax purposes.

| 42.4.1202 | APPLICATION OF CREDITS AGAINST CORPORATE INCOME TAX LIABILITY |

(1) Only the corporation that earned the tax credit may claim that credit against its own corporate income tax liability. A corporation earns a tax credit if it is the entity that made the qualifying investment or expenditure to generate the applicable tax credit.

(2) Except as provided for in 15-32-508, MCA, in the case of a merger or consolidation, if a credit is earned by a corporation that is no longer in existence the credit may not be claimed against the tax liability of the surviving corporation.

(3) Except as provided for in 15-32-508, MCA, in the case of a corporate entity that has converted to a disregarded entity, any credit earned by the entity prior to the conversion may not be claimed against the tax liability of another entity.

(4) As provided in (1), tax credits are applied on a separate entity basis. A tax credit may not be transferred, assigned, or otherwise used to reduce the tax liability of any other corporation, even if that other corporation is a member of the same unitary business group as the corporation that earned the credit.

| 42.4.1601 | DEFINITIONS |

This rule has been repealed.

| 42.4.1602 | CREDIT FOR NEW OR EXPANDING CORPORATIONS |

This rule has been repealed.

| 42.4.1603 | PERIOD OF ELIGIBILITY |

This rule has been repealed.

| 42.4.1604 | MANUFACTURING |

This rule has been repealed.

| 42.4.1605 | NEW CORPORATION |

This rule has been repealed.

| 42.4.1606 | EXPANDING CORPORATION |

This rule has been repealed.

| 42.4.1607 | COMPLIANCE WITH CERTAIN STATUTES REQUIRED |

This rule has been repealed.

| 42.4.1608 | SUBMISSION OF EMPLOYEE LISTS |

This rule has been repealed.

| 42.4.1609 | DETERMINATION OF NEW JOBS |

This rule has been repealed.

| 42.4.1610 | DETERMINATION OF WAGES |

This rule has been repealed.

| 42.4.1611 | AVAILABILITY OF TAX CREDIT |

This rule has been repealed.

| 42.4.1612 | WHEN CREDIT MAY BE CLAIMED |

This rule has been repealed.

| 42.4.1702 | CREDIT FOR EMERGENCY LODGING |

This rule has been repealed.

| 42.4.2202 | EMPLOYER APPRENTICESHIP TAX CREDIT |

(1) Subject to the restriction that apprenticeship tax credits may not exceed the taxpayer's total tax liability, the total amount of credit an employer participating in a state-registered apprenticeship training program may claim is determined by the Montana Department of Labor and Industry (DLI). The department can only adjust the total credit allocation among the owners of an S corporation, partnership, or limited liability company in order to conform to 15-30-2357 and 15-31-173, MCA, and this rule.

(a) If the employer is an S corporation, the shareholders' share of the total credit is based on their pro rata share of income or loss.

(b) If the employer is a partnership or a limited liability company that is taxed like a partnership, the partners' or members' share of the total credit is based on the their distributive share of the entity's income or loss reported for Montana income tax purposes.

(2) A taxpayer who files a tax return on a calendar year basis shall claim the credit for the tax year in which the DLI approved the credit.

(3) A taxpayer who files a tax return on a fiscal year basis shall claim the credit allowed for the calendar year that ends within the taxpayer's fiscal period.

(4) The taxpayer shall include copies of all tax certification numbers, agreements, DLI approval notice, and supporting documents when filing their return. If the return is filed electronically using software that does not support attachments, the taxpayer shall retain the information and provide it to the department upon request.

(5) When reviewing a claim for the credit, the department may request additional information to determine a taxpayer's eligibility for the allocation of the credit being claimed. This information may include, but is not limited to:

(a) a Montana Schedule K-1 issued by a partnership, S corporation, or fiduciary indicating the partner, shareholder, or beneficiary's share of the credit; or

(b) a return filed by a partnership, S corporation, or fiduciary including information showing the owners of the entity.

| 42.4.2301 | DEFINITIONS |

The following definitions apply to terms used in this subchapter:

(1) "Agreement" means the contract for participation entered into between the Montana Department of Fish, Wildlife and Parks (FWP) and the landowner(s) for purposes of guaranteeing access to public land under the unlocking public lands program.

(2) "Tax certification number" means the number issued by FWP certifying that the landowner is providing qualified access to public land under the unlocking public lands program provided for in 87-1-294, MCA.

| 42.4.2302 | CLAIMING THE UNLOCKING PUBLIC LANDS TAX CREDIT |

(1) To claim the unlocking public lands tax credit, a taxpayer shall file a Montana tax return (Form 2 for individuals, Form FID-3 for estates and trusts, or Form CIT for C corporations), whether or not they are otherwise required to file a tax return for the year the credit is being claimed.

(2) A taxpayer who files a tax return on a calendar year basis shall claim the credit for the tax year in which the agreement applied.

(3) A taxpayer who files a tax return on a fiscal year basis shall claim the credit for the tax year in which the agreement was certified by the Montana Department of Fish, Wildlife and Parks.

(4) The taxpayer shall include copies of all tax certification numbers, agreements, and supporting documents when filing their return. If the return is filed electronically using software that does not support attachments, the taxpayer shall retain the information and provide it to the department upon request.

(5) When reviewing a claim for the credit, the department may request additional information to determine a taxpayer's eligibility for the allocation of the credit being claimed. This information may include, but is not limited to:

(a) documentation establishing ownership and ownership percentage of the parcel(s);

(b) a Montana Schedule K-1 issued by a partnership, S corporation, or fiduciary indicating the partner, shareholder, or beneficiary's share of the credit; or

(c) a return filed by a partnership, S corporation, or fiduciary including information showing the owners of the entity.

| 42.4.2303 | ALLOCATION OF CREDIT FOR ACCESS THROUGH LAND WITH MULTIPLE OWNERS AND LAND OWNED BY PASS-THROUGH ENTITIES |

(1) For purposes of calculating the tax credit permitted by the unlocking public lands program, parcels held wholly or in part by an entity disregarded for tax purposes shall be treated as owned by the entity's owner or owners. For example, a parcel held in the name of a single-member limited liability company that is disregarded for tax purposes shall be considered as owned by the sole member, or sole member and spouse, if applicable.

(2) Unless substantiation of a different ownership split is provided by all landowners, the credit for access granted through land having multiple owners, such as two individuals or an individual and an unrelated corporation, shall be divided equally among the landowners.

(3) The credit for access through land owned by an S corporation must be allocated to its shareholders in the same manner the S corporation uses to allocate its items of income or loss to its owners for Montana income tax purposes.

(4) A partnership that is entitled to the credit may allocate the total credit in a manner that is mutually agreeable to its partners. Evidence of such an allocation may include, but is not limited to, Montana Schedules K-1, terms of the partnership agreement that are specific to this credit, or a separate agreement between the partners regarding the allocation of this credit. If evidence of the allocation is not provided to the department upon request, or if the information provided is deficient, the total credit must be allocated to the partners in the same manner the partnership allocated its income and losses to its owners for Montana income tax purposes.

| 42.4.2402 | INSURE MONTANA REFUNDABLE CREDIT |

This rule has been repealed.

| 42.4.2403 | REDUCTION OF DEDUCTIONS ALLOWED FOR INSURANCE CLAIMS |

This rule has been repealed.

| 42.4.2404 | COORDINATION WITH OTHER HEALTH INSURANCE CREDITS |

This rule has been repealed.

| 42.4.2501 | DEFINITIONS |

This rule has been repealed.

| 42.4.2502 | CARRYOVER AND RECAPTURE OF OILSEED CRUSH FACILITY TAX CREDIT |

This rule has been repealed.

| 42.4.2503 | CARRYOVER AND RECAPTURE OF BIODIESEL OR BIOLUBRICANT PRODUCTION FACILITY TAX CREDIT |

This rule has been repealed.

| 42.4.2504 | CARRYOVER AND RECAPTURE OF BIODIESEL BLENDING AND STORAGE TAX CREDIT |

(1) If any part of the credit earned in taxable years beginning after December 31, 2004, is not applied against the tax liability for the year earned, the unused portion of the credit can be carried forward to offset tax liability in the next seven periods.

(2) The credit may be subject to recapture if the facility claiming the credit ceases blending of biodiesel with petroleum diesel for sale for a period of 12 consecutive months. At the point the facility ceases blending of biodiesel with petroleum diesel, any credit claimed in the five years prior to the cease date must be recaptured.

| 42.4.2505 | CARRYOVER AND RECAPTURE OF OILSEED CRUSH FACILITY TAX CREDIT |

| 42.4.2601 | DEFINITIONS |

The following definitions apply to this subchapter:

(1) "Finished product" means a marketable product that has economic value and is ready to be used by a consumer.

(2) "Machinery or equipment" is property having a depreciable life of more than one year, whose primary purpose is to collect or process reclaimable material or is depreciable property used in the manufacturing of a product from reclaimed material.

(3) "Primarily" means over 50% of time, usage, or other appropriate measure.

(4) "Process or processing" means preparation, treatment, including treatment of hazardous waste as defined in 75-10-403, MCA, or conversion of a product or material by an action, change, or function or a series of actions, changes, or functions that bring about a desired end result.

(5) "Reclaimed material" is post-consumer material that has been collected and used in a process designed to produce recycled material.

(6) "Recycled material" means a material that can be readily utilized without further processing in place of raw or virgin material in manufacturing a product and consists of materials derived from post-consumer waste, industrial scrap, and material derived from agricultural wastes and other items, all of which can be used in the manufacture of new products.

| 42.4.2602 | ADDITIONAL DEDUCTION FOR PURCHASE OF RECYCLED MATERIAL |

(1) Businesses, including corporations, individuals, and partnerships, may take an additional 10 percent deduction of the expenses related to the purchase of recycled products used within Montana in their business if the recycled products purchased contain recycled material at a level consistent with industry standards and/or standards established by the Federal Environmental Protection Agency when such standards exist. The department may request the assistance of the Montana Department of Environmental Quality to determine if the product qualifies as a recycled product. Due to continuing technological advances in the recycling industry, the standards will be subject to constant change. The industry standards to be used will be those in effect at the time the product was purchased.

(2) For a taxpayer paying individual income tax, the deduction is an adjustment to federal adjusted gross income for individual income tax.

(3) For a corporation paying the corporate income tax/alternative corporate income tax, the deduction is an adjustment to federal taxable income for the corporate income tax/alternative corporate income tax.

(4) A shareholder of an S corporation may claim a share of the allowable deduction for expenditures that the S corporation incurred for purchase of qualified recycled material based on the shareholder's pro rata share of their ownership in the S corporation. A partner of a partnership may claim a share of the allowable deduction for expenditures the partnership incurred for the purchase of qualified recycled material in the same proportion used to report the partnership's income or loss for Montana income tax purposes.

(5) Any deductions claimed are subject to review by the department. The responsibility to maintain accurate records to substantiate deductions remains with the taxpayer.

| 42.4.2604 | CREDIT FOR INVESTMENTS IN DEPRECIABLE EQUIPMENT OR MACHINERY TO COLLECT, PROCESS, OR MANUFACTURE A PRODUCT FROM RECLAIMED MATERIAL, OR PROCESS SOILS CONTAMINATED BY HAZARDOUS WASTES |

(1) The credit is subject to the limitations outlined in 15-32-602 , MCA, and is available only for the acquisition of machinery and/or equipment that is depreciable, as defined in Section 167 of the IRC. The machinery and/or equipment must be used in Montana primarily for the collection or processing of reclaimable material, or in the manufacture of finished products from reclaimed material.

(2) The basis for the credit is generally the cost of the property before consideration of trade-in equipment. An exception to this is that the basis shall be reduced by any trade-in which has had this credit previously taken on it. This includes the purchase price, transportation cost (if paid by the purchaser) , and the installation cost before depreciation or other reductions. This credit does not increase or decrease the basis for tax purposes. Leased equipment is restricted to capital leases, and the credit is calculated on the amount capitalized for balance sheet purposes under generally accepted accounting principles.

(3) Recycling machinery and/or equipment must be located and operating in Montana on the last day of the taxable year for which the credit is claimed. The machinery or equipment must be used to:

(a) collect;

(b) process;

(c) separate;

(d) modify;

(e) convert; or

(f) treat solid waste into a product that can be used in place of a raw material for productive use or treat soil that has been contaminated by hazardous wastes.

(4) Examples may include, but are not limited to:

(a) balers;

(b) bobcats;

(c) briquetters;

(d) compactors;

(e) containers;

(f) conveyors;

(g) conveyor systems;

(h) cranes with grapple hooks or magnets;

(i) crushers;

(j) end loaders;

(k) exhaust fans;

(l) fork lifts;

(m) granulators;

(n) lift-gates;

(o) magnetic separators;

(p) pallet jacks;

(q) perforators;

(r) pumps;

(s) scales;

(t) screeners;

(u) shears;

(v) shredders;

(w) two-wheel carts; and

(x) vacuum systems.

(5) This does not include transportation equipment, unless it is specialized to the point that it can only be used to collect and process reclaimable material or treat soil that has been contaminated by hazardous wastes.

(6) In the instance of the specialized mobile equipment that does qualify and is used both within and outside of Montana, the credit must be prorated using the following calculation:

D x C x E = Credit allowed

T

C = credit % in 15-32-602 , MCA

D = days used in Montana

E = cost of equipment

T = total days used

(7) Absent a specific agreement to the contrary, the owners of a small business corporation, partnership, or sole proprietorship must prorate the credit in the same proportion as their ownership in the business.

(8) Only a taxpayer that owns an interest, either directly or through a pass-through entity such as a partnership or S corporation, and is operating the equipment as the primary user on the last business day of the year, may claim the credit.

(9) The credit is limited to the amount of the taxpayer's income or corporation tax liability. Any excess credit is not refundable, nor can it be carried back or forward to other tax years.

(10) The department may disallow a credit resulting from a sale or lease when the overriding purpose of the transaction is not to collect or process reclaimable material, or manufacture a product from reclaimed material.

| 42.4.2605 | PERIOD COVERED FOR THE RECLAMATION AND RECYCLING CREDIT |

(1) The credit must be taken in the tax year in which the machinery/equipment was acquired and placed into service.

(2) Any credit claimed is subject to review by the department. The department may request the assistance of the Montana Department of Environmental Quality when making its determinations. The responsibility to maintain accurate records to substantiate the credit remains with the taxpayer.

| 42.4.2701 | DEFINITIONS |

The following definitions apply to this subchapter:

(1) "Allowable contribution" for the purposes of the qualified endowment credit is a charitable gift made to a qualified endowment. The contribution from an individual to a qualified endowment must be by means of a planned gift as defined in 15-30-2327, MCA. A contribution from a corporation, small business corporation, estate, trust, partnership, or limited liability company may be made by means of a planned gift or may be made directly to a qualified endowment.

(2) "Donor" means an individual, corporation, estate, or trust that contributes to a qualified charitable endowment as required by 15-30-2327, 15-30-2328, 15-30-2329, 15-31-161, and 15-31-162, MCA.

(3) "Paid-up life insurance policies" are life insurance policies in which all the premiums have been paid prior to the policies being contributed to a qualified endowment. The donor must make the tax-exempt organization the owner and beneficiary of the policy. The paid-up life insurance policy does not have to be on the life of the donor.

(4) "Permanent irrevocable fund" means a fund comprised of one or more assets that are invested and appropriated pursuant to the Uniform Prudent Management of Institutional Funds Act provided for in Title 72, chapter 30, MCA. Investment assets may include cash, securities, mutual funds, or other investment assets. A "building fund" or other fund that is used to accumulate contributions that will be expended is not a permanent irrevocable fund. A fund from which contributions are expended directly for constructing, renovating, or purchasing operational assets, such as buildings or equipment, is not a permanent irrevocable fund.

(5) "Present value of the charitable gift portion of a planned gift" is the allowable amount of the charitable contribution as defined in 15-30-2131, and 15-30-2152, MCA, or for corporations as defined in 15-31-114, MCA, prior to any percentage limitations.

(6) "Qualified endowment" means a permanent irrevocable fund established for a specific charitable, religious, educational, or eleemosynary purpose by an organization qualified to hold it as provided in ARM 42.4.2703.

| 42.4.2703 | ELIGIBILITY REQUIREMENTS TO HOLD A QUALIFIED ENDOWMENT |

(1) To hold a qualified endowment an organization must be:

(a) incorporated or otherwise formed under the laws of Montana and exempt from federal income tax under 26 USC 501(c)(3); or

(b) a Montana chartered bank or trust company, as defined in 15-30-2327, MCA, holding an endowment fund on behalf of a Montana or foreign 501(c)(3) organization.

(2) A qualifying gift to an institution meeting the definition in (1)(b) at the time of the gift remains a qualifying gift even if subsequent changes to the institution mean it no longer meets the definition of an entity eligible to hold a qualified endowment. For example, a qualifying gift to a Montana chartered bank remains a qualifying gift even if the bank is subsequently acquired and absorbed by a nationally chartered bank.

| 42.4.2704 | TAX CREDIT AND DEDUCTION LIMITATIONS |

(1) The credit allowed the corporation, estate, trust, or individual against its tax liability for a contribution of a planned gift is the percentage, as shown in the following table, of the present value of the allowable contribution as defined in ARM 42.4.2701. The credit allowed against the tax liability of the corporation, estate, or trust for a direct contribution is equal to 20 percent of the charitable contribution. The maximum credit that may be claimed in one year is $10,000 per donor. A contribution made in a previous tax year cannot be used for a credit in any subsequent tax year.

Planned Gifts by Individuals or Entities

| Planned Gift Date |

Percent of Present Value |

Used to Calculate Maximum Credit |

Maximum Credit Per Year |

| 7/1/03 - 12/31/19 |

40% |

$25,000 | $10,000 |

(2) The credit allowed against the corporate, estate, trust, or individual tax liability for a charitable gift made by a corporation, small business corporation, estate, trust, partnership, or limited liability company directly to a qualified endowment is the percentage, as shown in the following table, of the allowable contribution as defined in ARM 42.4.2701.

Unplanned Gifts by Eligible Entities

| Qualified Charitable Gift Date | Percent of Allowable Contribution |

Allowable Contribution Used to Calculate Maximum Credit |

Maximum Credit Per Year |

| 7/1/03 - 12/31/19 |

20% |

$50,000 | $10,000 |

(3) The balance of the allowable contributions not used in the credit calculation may be used as a deduction subject to the limitations and carryover provisions found in 15-30-2131, MCA, or for corporations, the limitations and carryover provisions found in 15-31-114, MCA.

(a) Example of an allowable deduction when a planned gift is used for the Qualified Endowment Credit:

| Time Period | Present Value | Maximum Credit | Credit Percentage | Allowable Deduction |

| 7/1/03 - 12/31/19 | $50,000- | ($10,000 / | .40) = | $25,000 |

(b) Example of an allowable deduction when an outright gift is used for the Qualified Endowment Credit:

| Time Period | Market Value | Maximum Credit | Credit Percentage | Allowable Deduction |

| 7/1/03 - 12/31/19 | $55,000- | ($10,000 / | .20) = | $5,000 |

(4) A contribution to a qualified endowment by a small business corporation, partnership, or limited liability company qualifies for the credit only if the entity carried on a trade or business or rental activity during the tax year the contribution was made.

(5) The contribution to a qualified endowment from a small business corporation, partnership, or limited liability company is passed through to the shareholders, partners, or members in the same proportion as their distributive share of the entity's income or loss for Montana income tax purposes. The proportionate share of the contribution passed through to each shareholder, partner, or member becomes an allowable contribution for that donor for that year, and the credit allowed and the excess contribution deduction allowed are calculated as set forth in (1) and (2). The credit maximums apply at the corporation and individual levels, and not at the pass-through entity's level for partnerships, small business corporations, and limited liability companies.

(6) Deductions and credit limitations for an estate or trust are as follows:

(a) if an estate or trust claims a credit based on the computation of the full amount of the contribution, there is no credit available to beneficiaries;

(b) any portion of a contribution not used in the calculation of credit for the estate may be passed through to the beneficiaries, in the same proportion as their distributive share of the estate's or trust's income or loss for Montana income tax purposes; however, beneficiaries may deduct only that portion of allowable contributions not used toward the credit or deduction claimed by the estate or trust; or

(c) if the estate or trust has deducted the full amount of the contribution, the credit may not be claimed by either the estate, trust, or the individual beneficiaries.

(7) The rate a beneficiary will use to calculate their credit for an allowable contribution passed to them by an estate will be based on the nature of the gift made by the estate. For example, if an estate makes an outright gift to a qualified endowment on July 17, 2017, and the contribution is passed to a beneficiary, the beneficiary will calculate their credit using the 20 percent rate.

(8) At no time can a corporation, small business corporation, partnership, limited liability company, estate, trust, or individual be allowed to receive the benefit of both a contribution deduction and a credit from the same portion of a contribution.

(9) The maximum credit that may be claimed in a tax year by any donor for allowable contributions from all sources is limited to the maximum credit stated in (1) and (2). In the case of a married couple that makes a joint contribution, the contribution is assumed split equally. If each spouse makes a separate contribution, each may be allowed the maximum credit as stated in (1) and (2).

(a) Example 1: Assume a married couple makes a joint planned gift to a qualified endowment on September 1, 2017. The allowable contribution made by the couple is $30,000. That couple is eligible to take a credit of up to $12,000, with each claiming a credit of $6,000.

(b) Example 2: Assume a married couple makes separate planned gifts to qualified endowments on September 1, 2017, which result in an allowable contribution of $20,000 for each person. They each would be eligible to take a credit of up to $8,000.

(10) A donor may, at a later date, name or substitute the Montana qualified endowment, as defined in 15-30-2327, MCA, to receive the planned gift provided that the original trust or gift document reserves in the donor the right to do so.

| 42.4.2705 | CREATING A PERMANENT IRREVOCABLE FUND |

(1) A permanent, irrevocable fund can be created by a restriction in the applicable planned gift document indicating the donor's intention that the contribution shall be held in a permanent, irrevocable fund. For planned gifts other than paid-up life insurance policies, the applicable planned gift document is the trust document, gift annuity contract, life estate agreement or pooled income fund agreement.

(2) A permanent irrevocable fund can be created in a separate gift document accompanying an outright contribution.

(3) A permanent irrevocable fund may be created by either a qualified organization referenced in ARM 42.4.2703 under a separate governing document or when a donor creates an endowment through a gift document.

(4) By creating a permanent, irrevocable fund and receiving the credit, the donor waives the right under 72-30-207, MCA, to release the restriction in the gift document.

(5) All funds created by donors or qualified organizations must meet the requirements of a permanent irrevocable fund provided in these rules.

| 42.4.2706 | REPORTING REQUIREMENTS |

(1) The donor must attach a copy of the following information to the tax return reporting the credit:

(a) a receipt acknowledging the amount of the allowable contribution from the:

(i) tax-exempt organization under 26 USC 501(c)(3) holding the qualified endowment receiving the contribution;

(ii) trustee of the trust administering the planned gift; or

(iii) bank or trust company holding a qualified endowment on behalf of a tax exempt organization.

(b) the date of the contribution to the qualified endowment or the planned gift;

(c) the name of the organization incorporated or established in Montana holding the qualified endowment fund or the name of the tax exempt organization on behalf of which the qualified endowment fund is held;

(d) in the case of a charitable trust where the charity is yet to be named, the donor shall include a copy of the disposition clause of the charitable trust which gives evidence that a qualified endowment fund has been created;

(e) a description of the type of gift, i.e. outright gift, charitable remainder unitrust, charitable gift annuity, etc.; and

(f) in the case of an outright gift, the receipt in (a) must state that the contribution was placed in a permanent irrevocable fund as defined in ARM 42.4.2701.

(2) The information required by these rules will be reported on forms prescribed and made available by the department.

| 42.4.2707 | QUALIFIED ENDOWMENT CREDIT FOR CORPORATIONS |

This rule has been repealed.

| 42.4.2708 | DETERMINING PRESENT VALUE FOR THE ENDOWMENT CREDIT |

(1) For purposes of determining the endowment credit, the present value of a contribution is the amount reported to the Internal Revenue Service for that contribution. The present value of a gift contributed to a qualified endowment is based on its fair market value on the date of the gift.

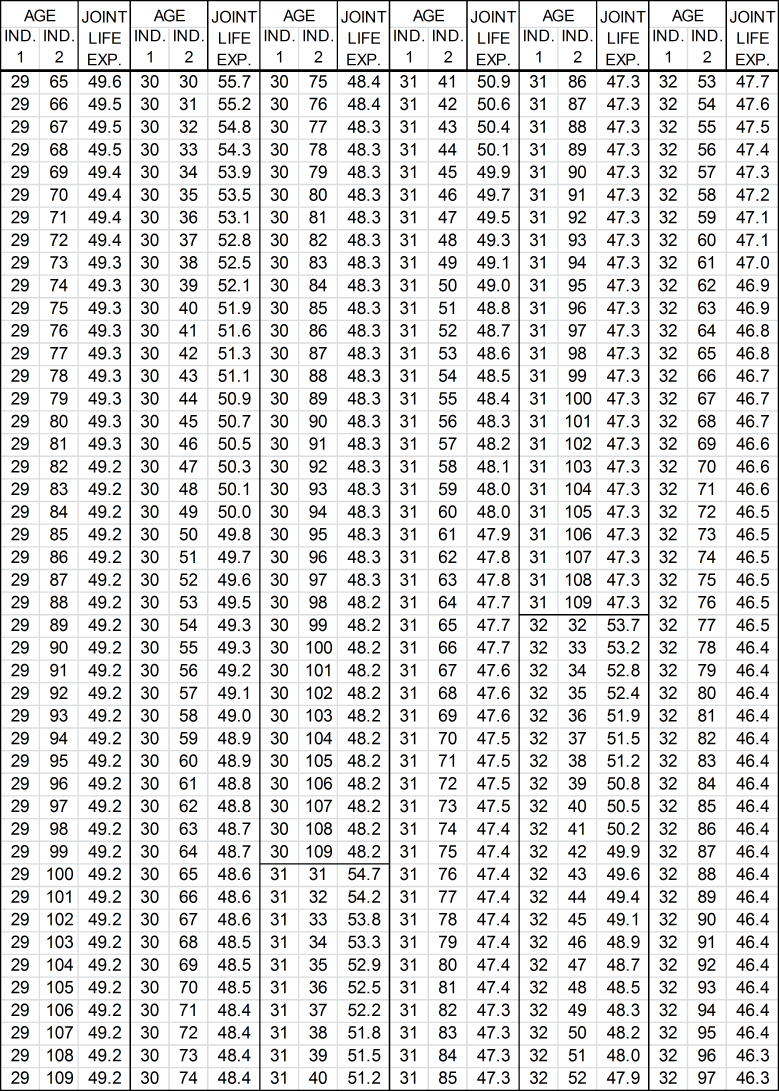

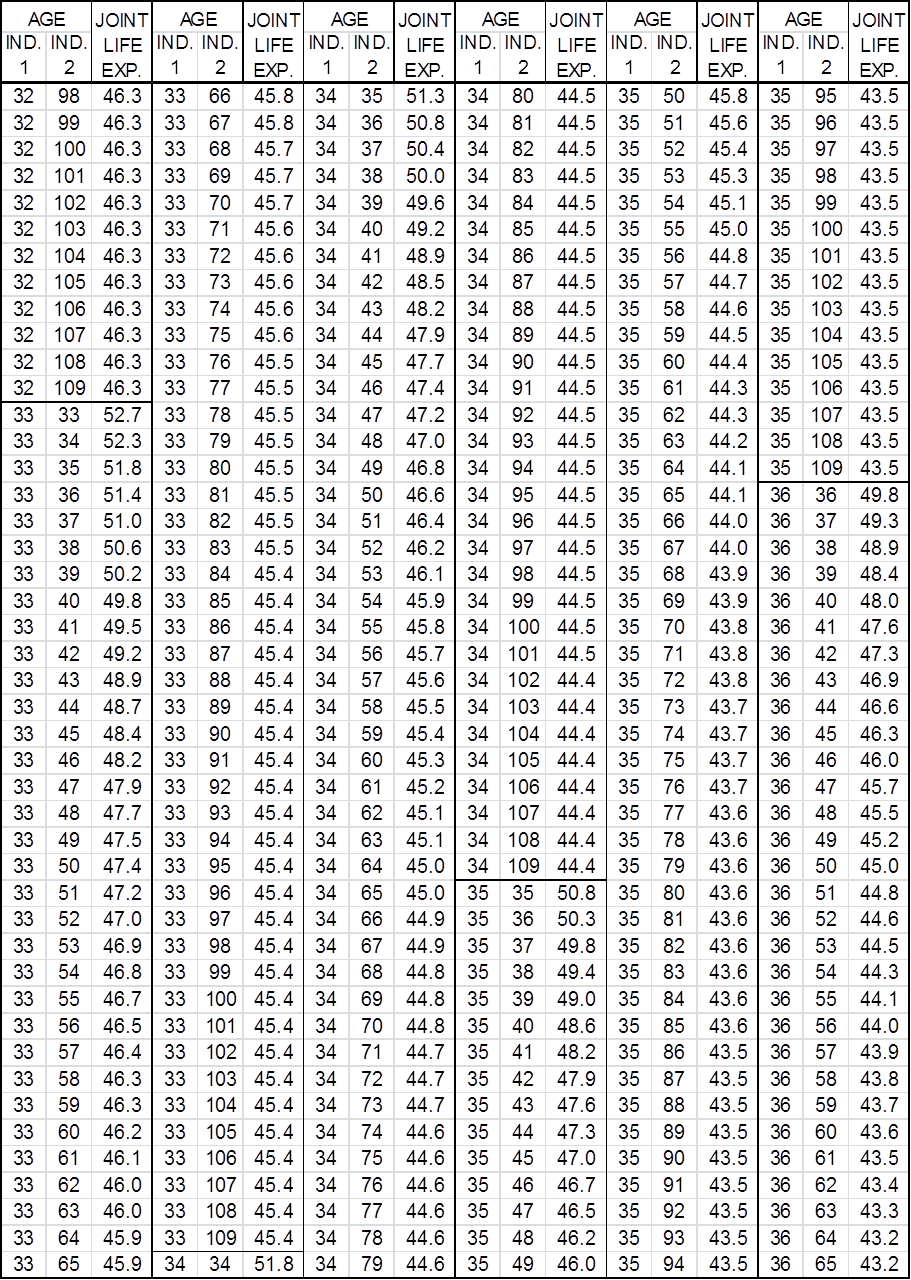

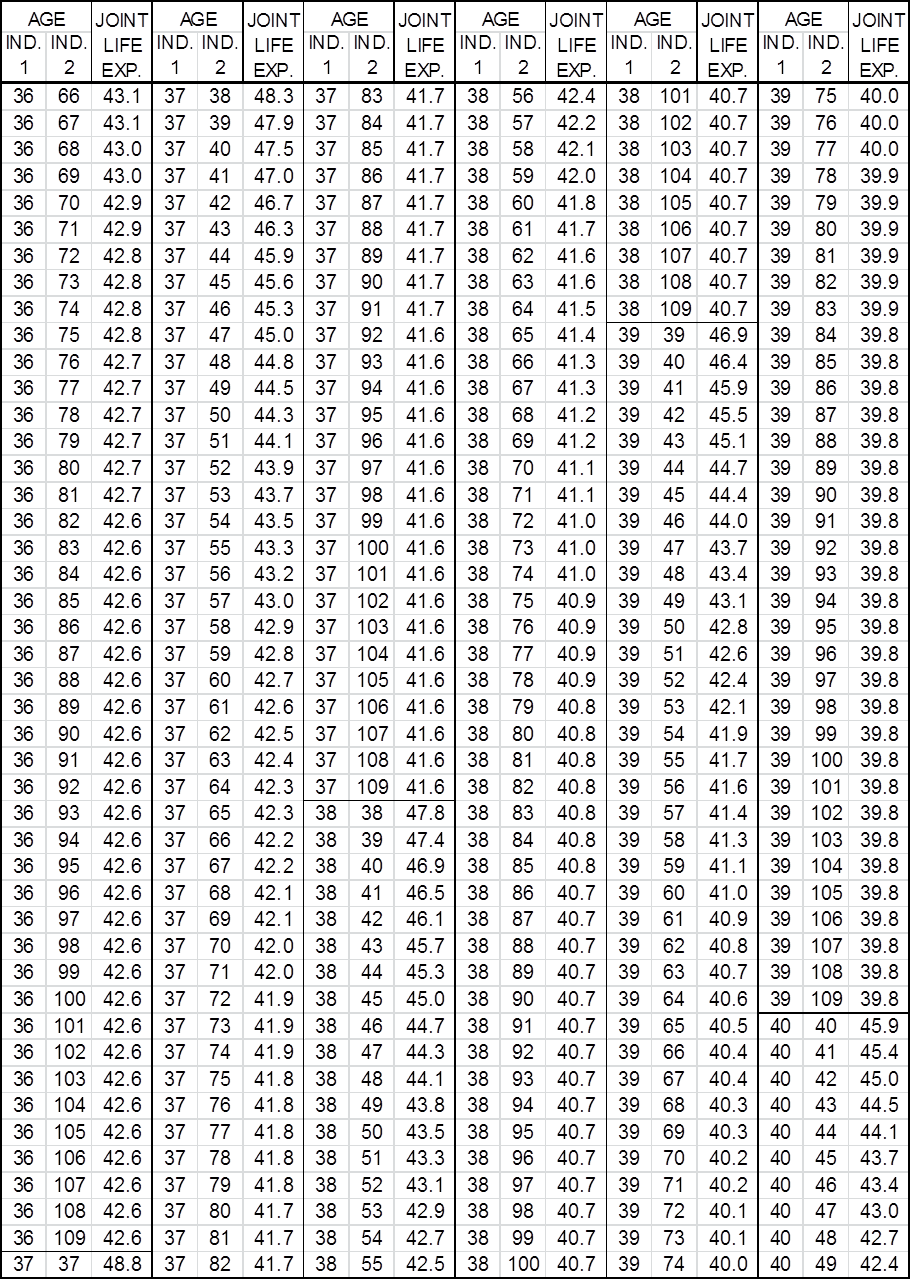

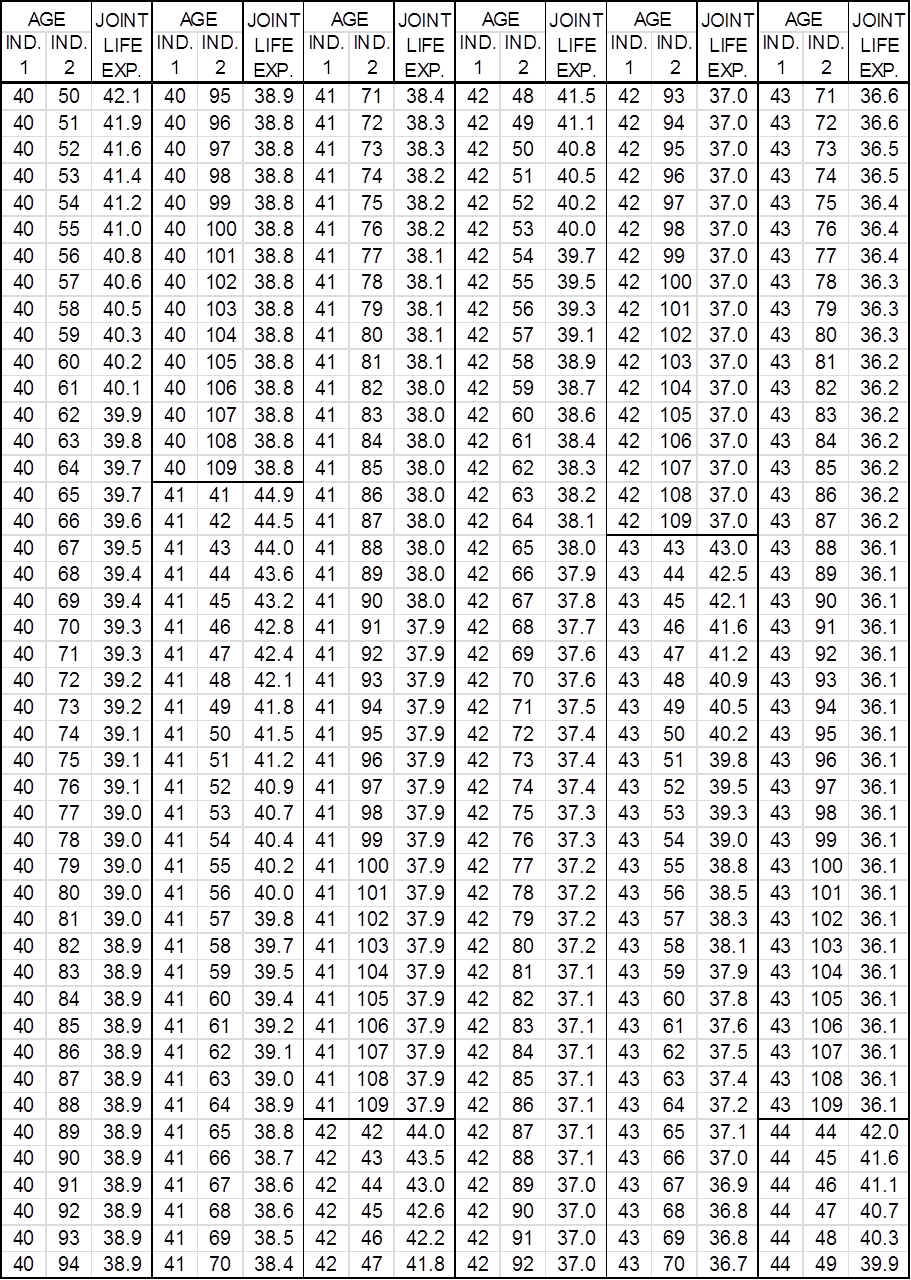

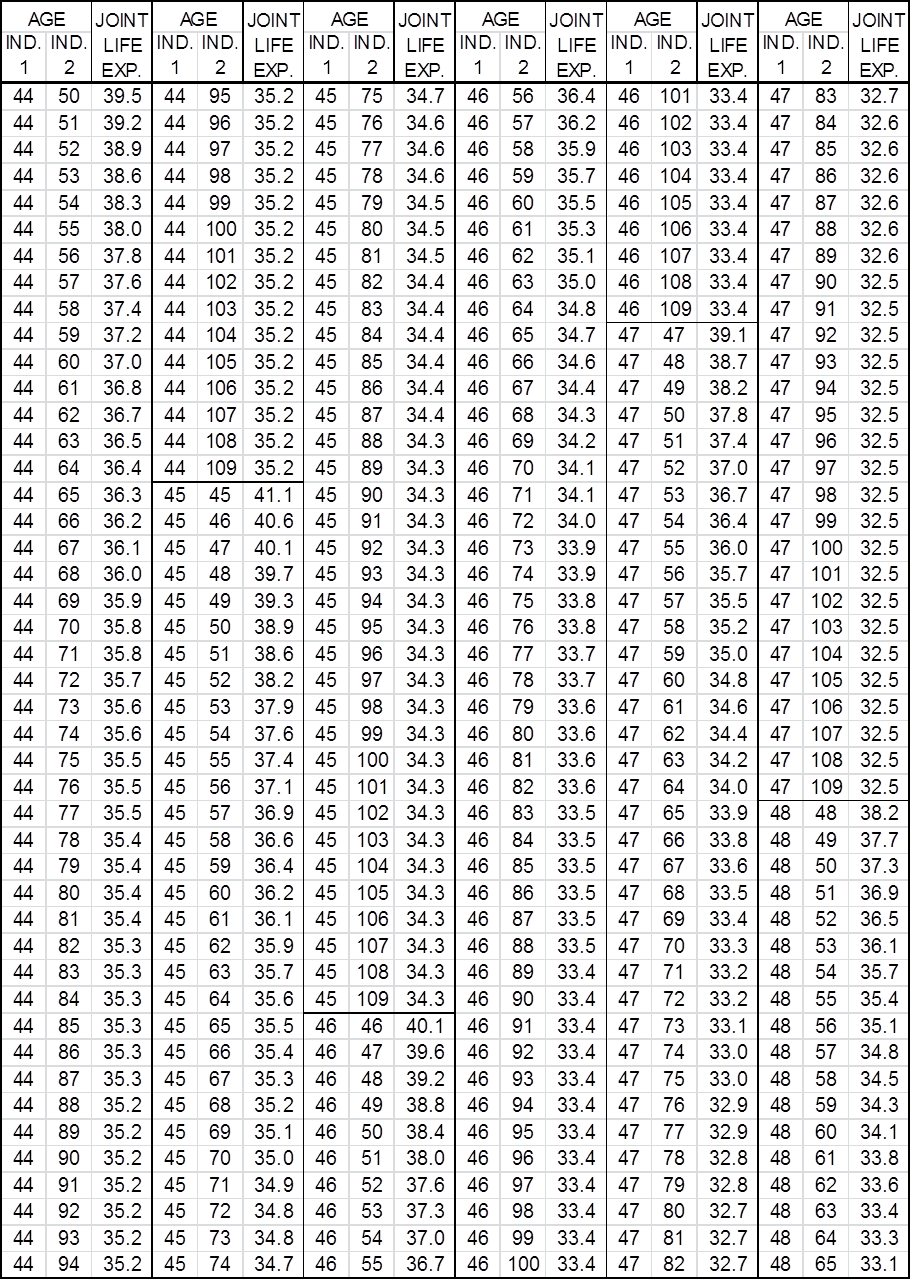

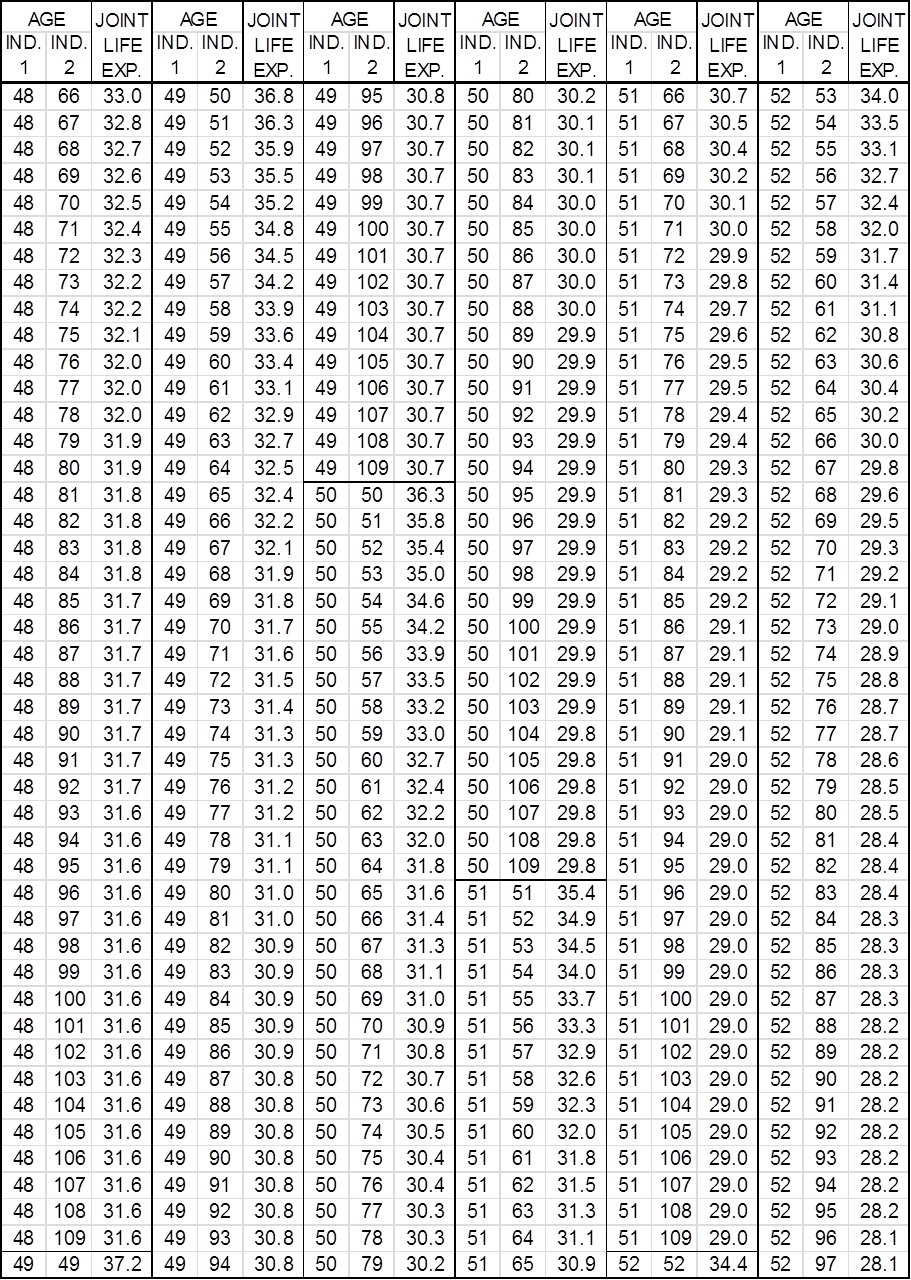

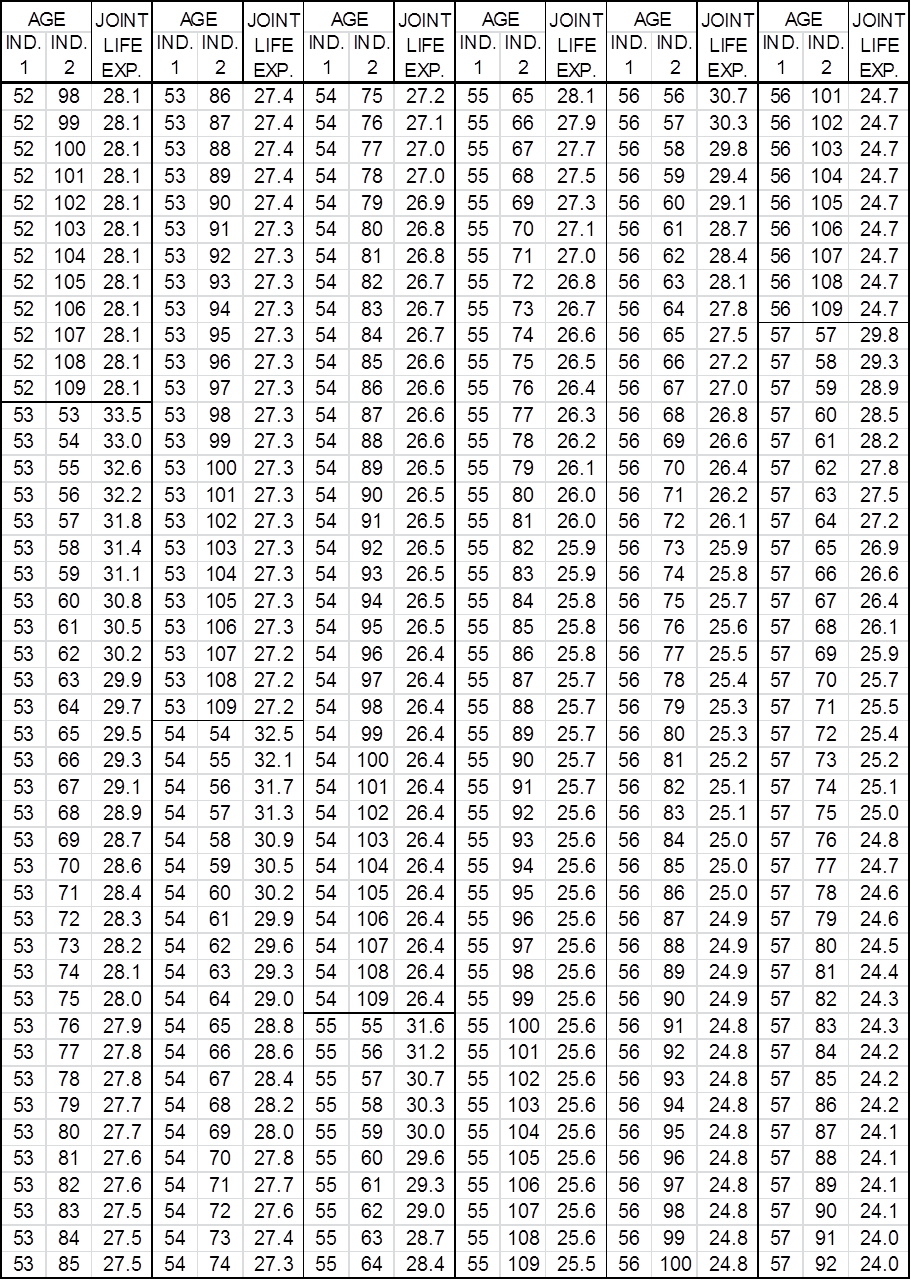

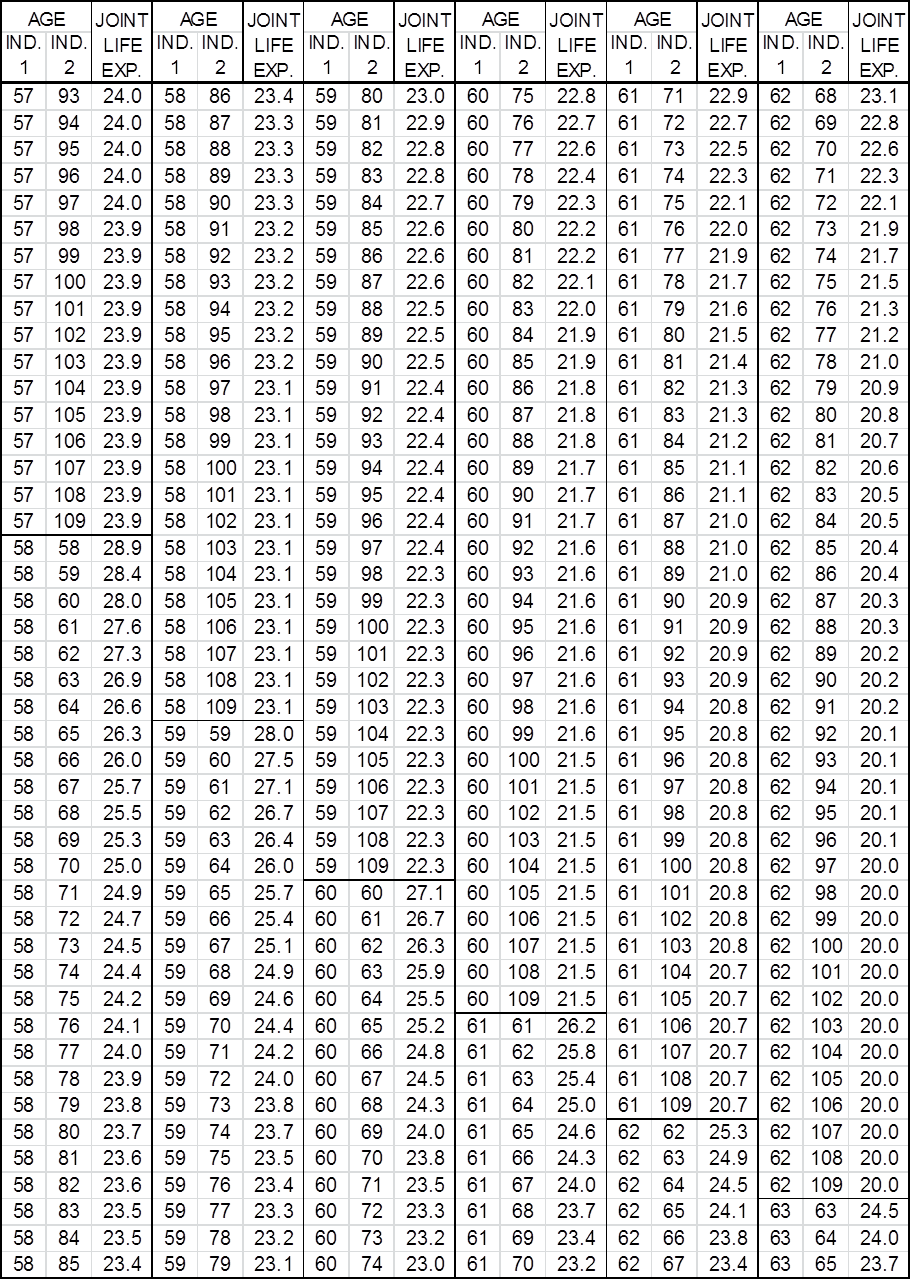

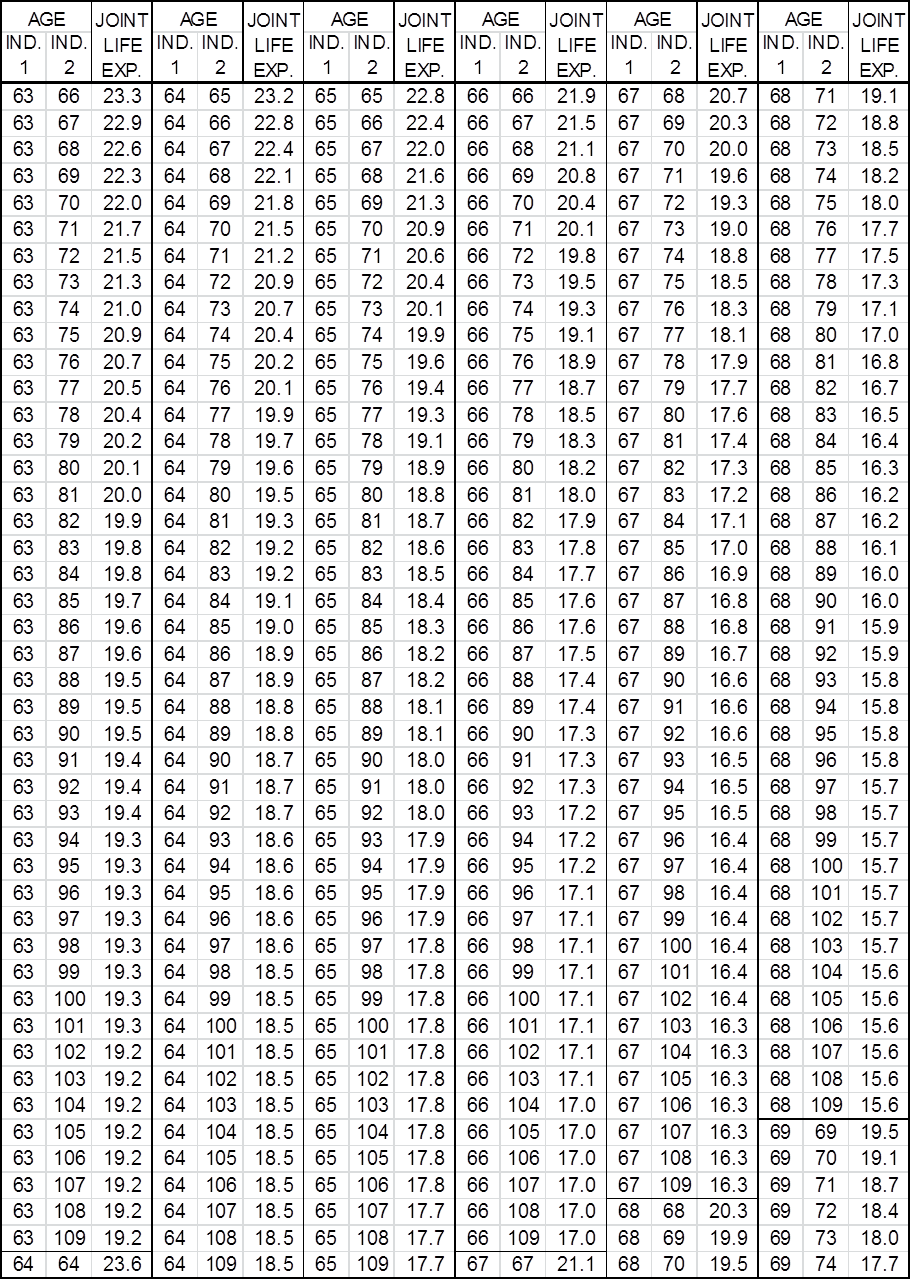

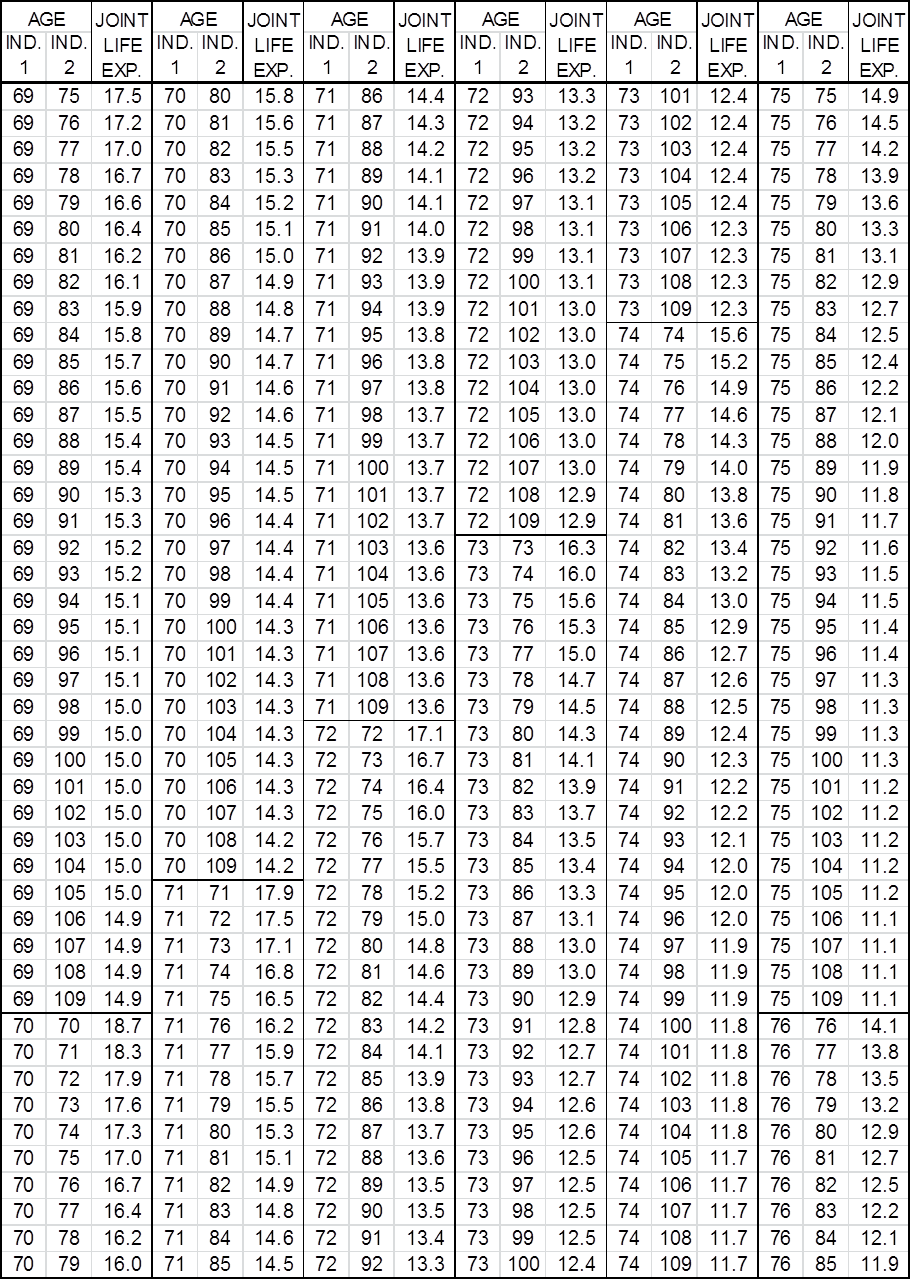

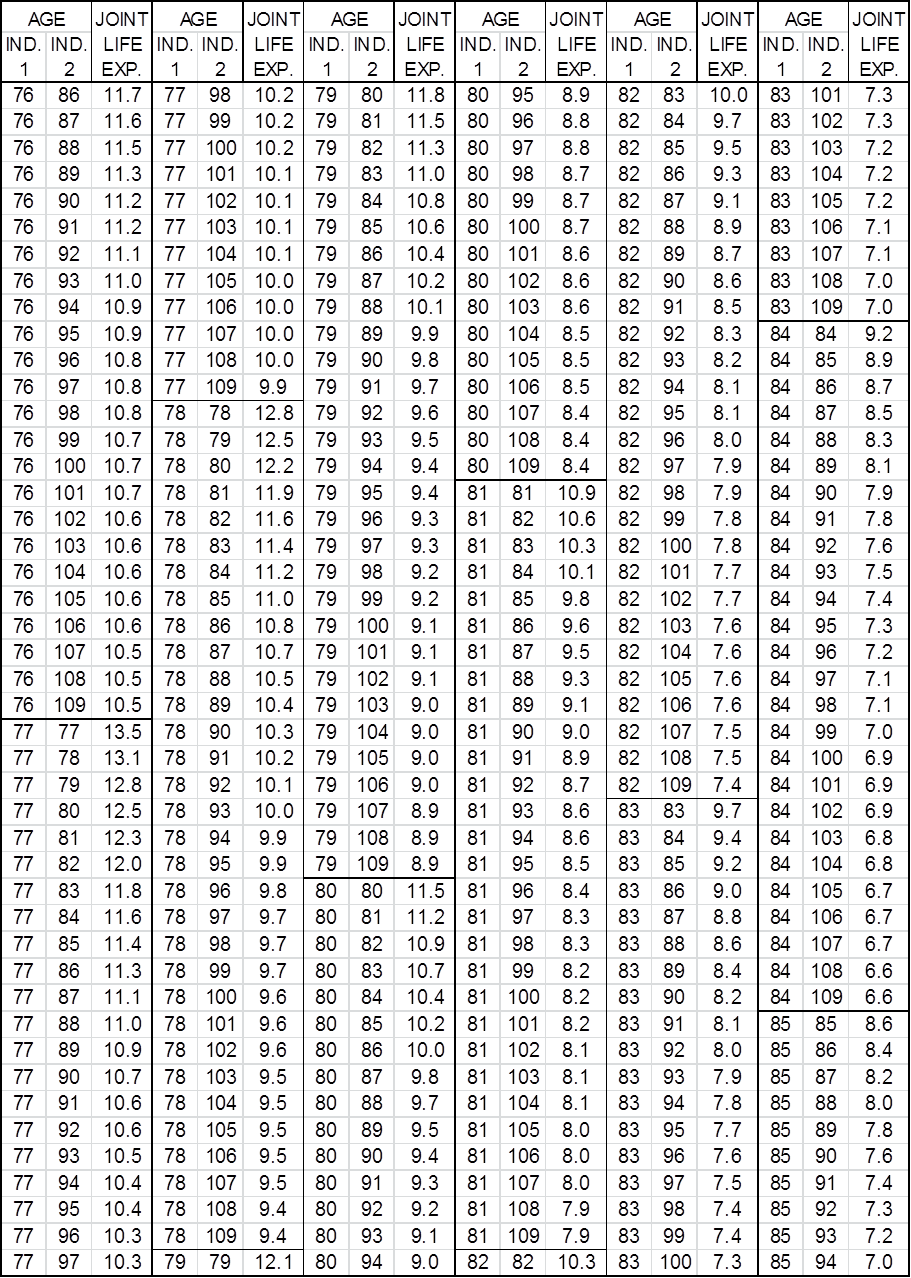

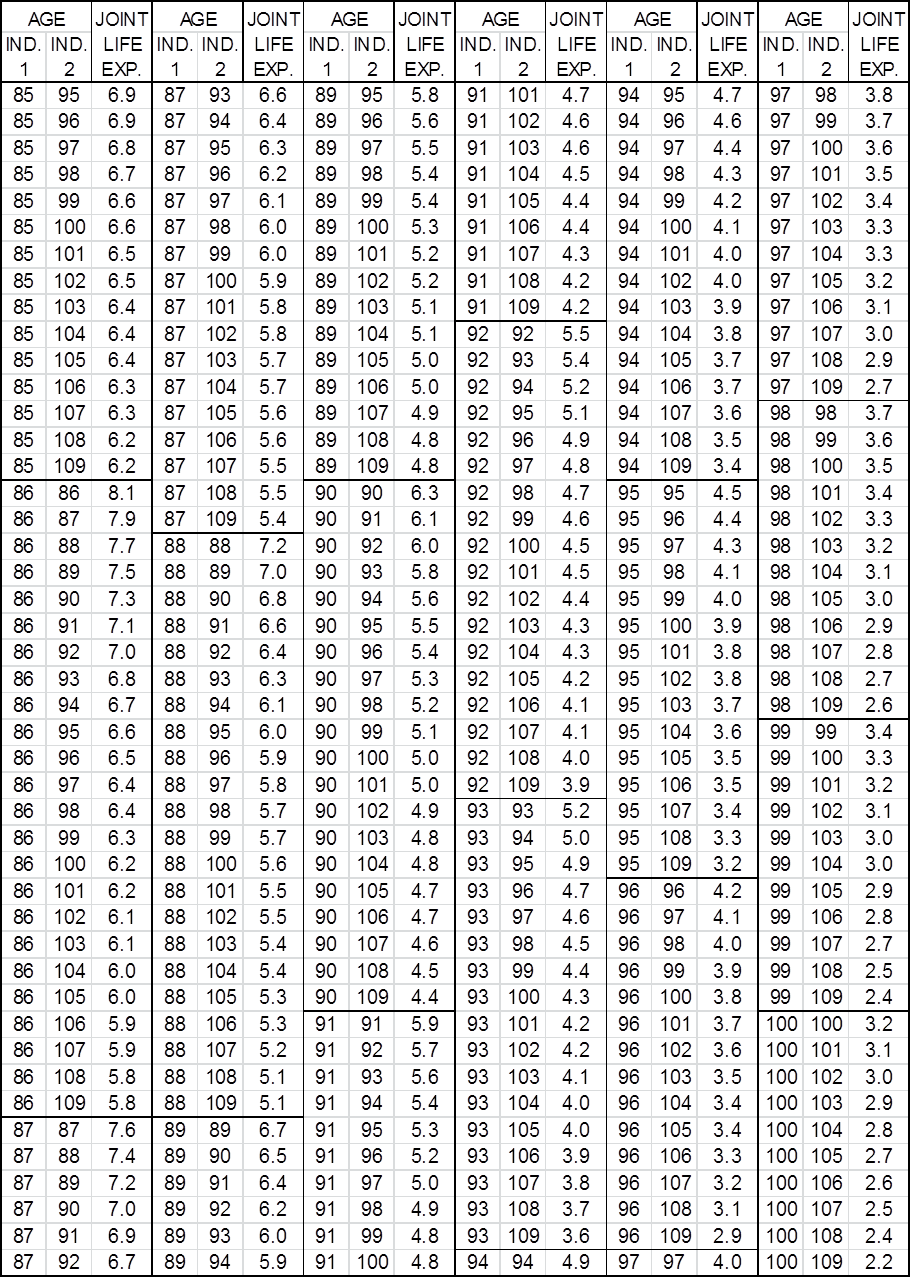

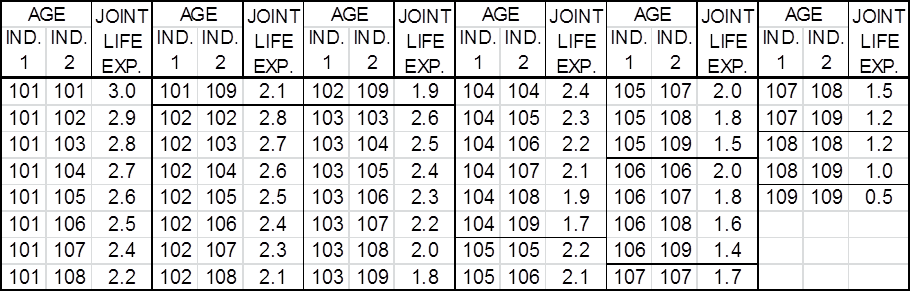

(2) As derived from the May 2009 IRS Publication 1457 titled "Actuarial Valuations," the life expectancy tables that shall be used when determining the life expectancy of the annuitant or joint life expectancy of the annuitants, within which the first partial or full-year payment of a deferred charitable gift annuity is required to begin in order for it to be deemed a planned gift for the purposes of 15-30-2327, MCA, are set forth in Tables 1 and 2.

(a) Example. The table indicates a 98-year-old annuitant has a life expectancy of 2.5 years. So the first partial year (such as a monthly, quarterly, or semi-annual payment), or full year payment mandated by the annuity contract, must be required to be paid no later than two and one-half years from the date the deferred annuity contract is created.

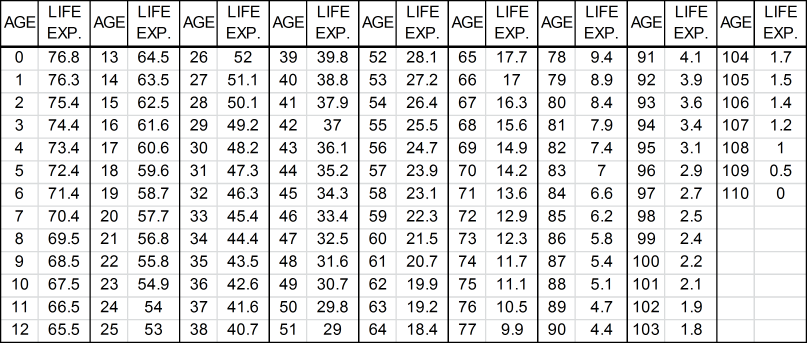

Table 1: Single Life Expectancies Based on 2000 CM Mortality

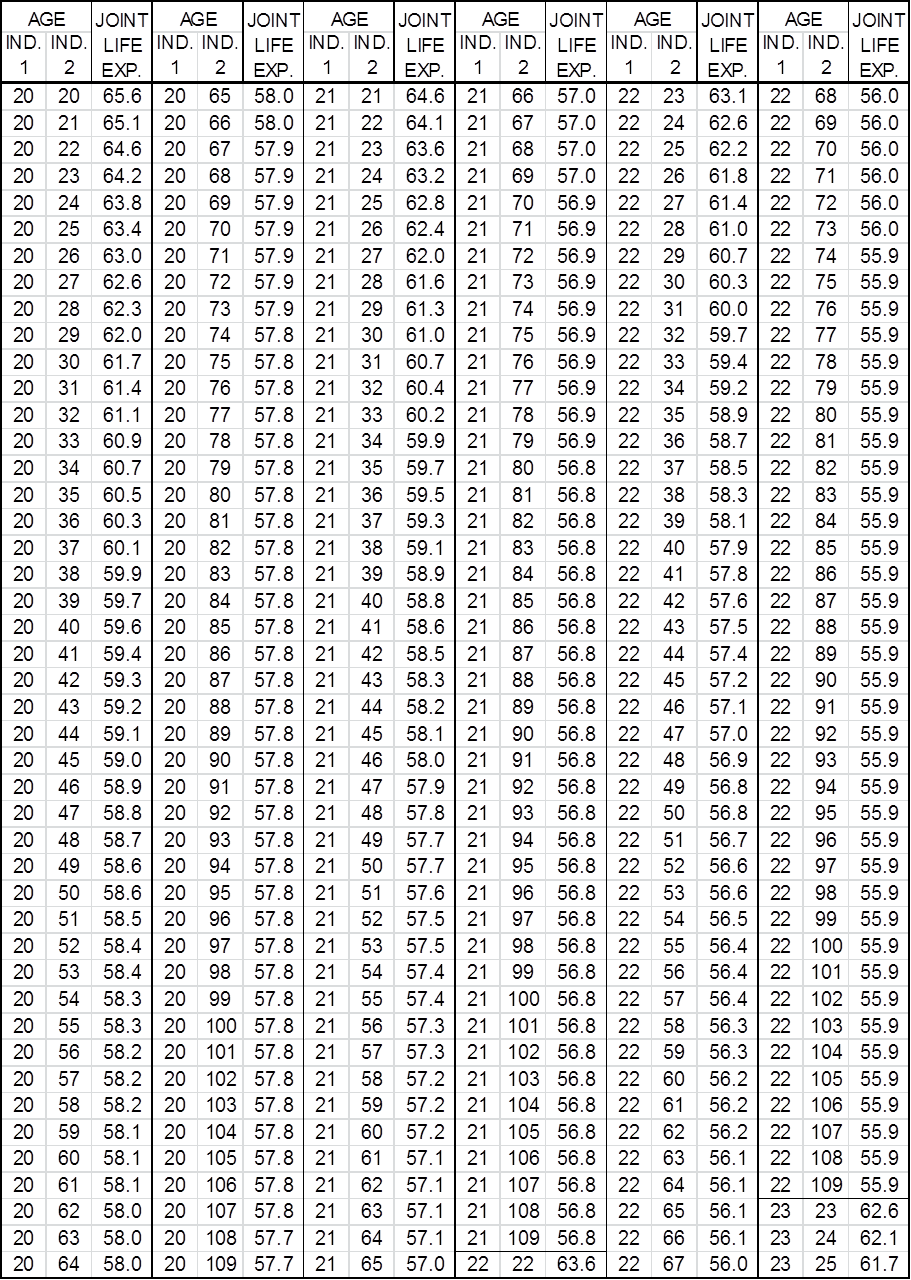

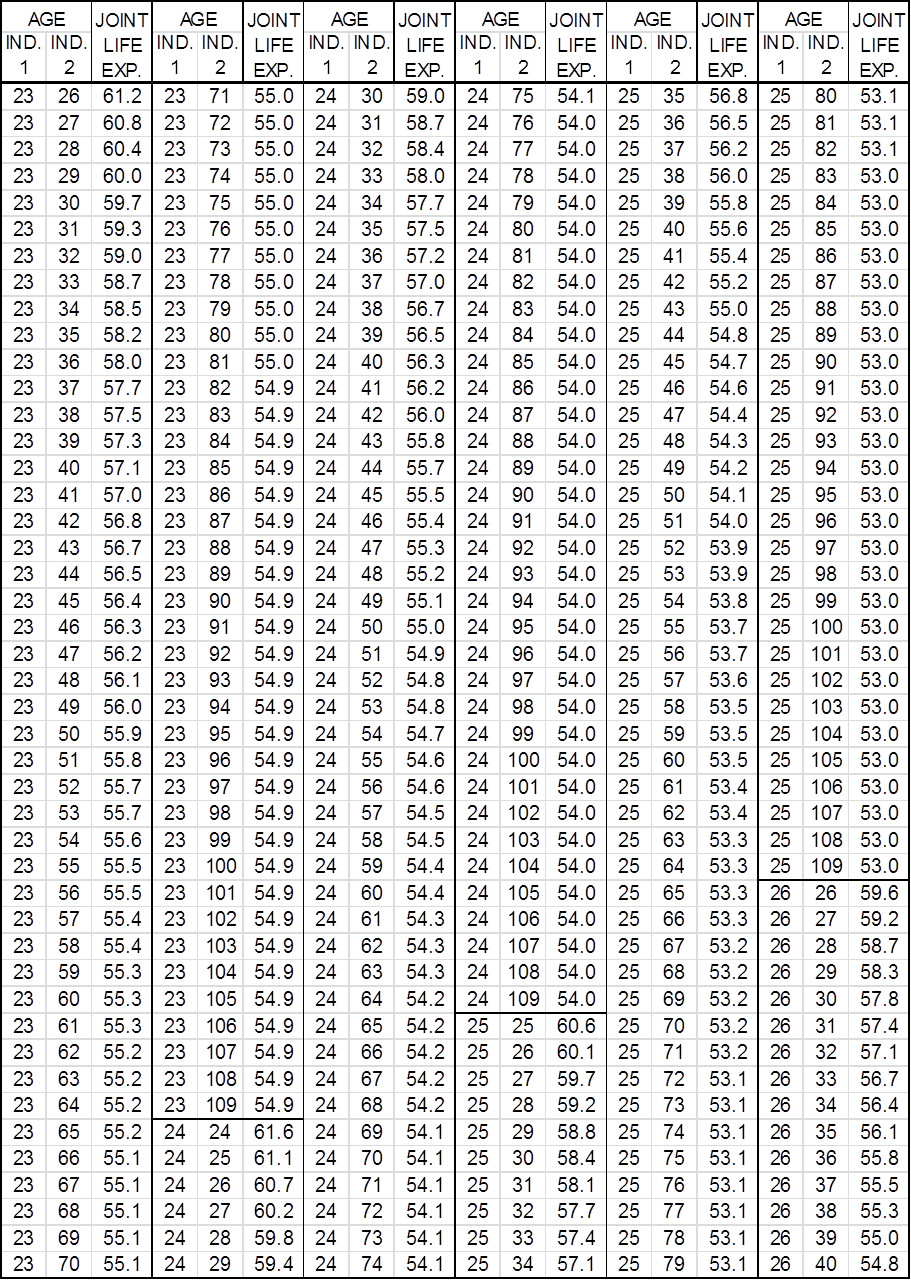

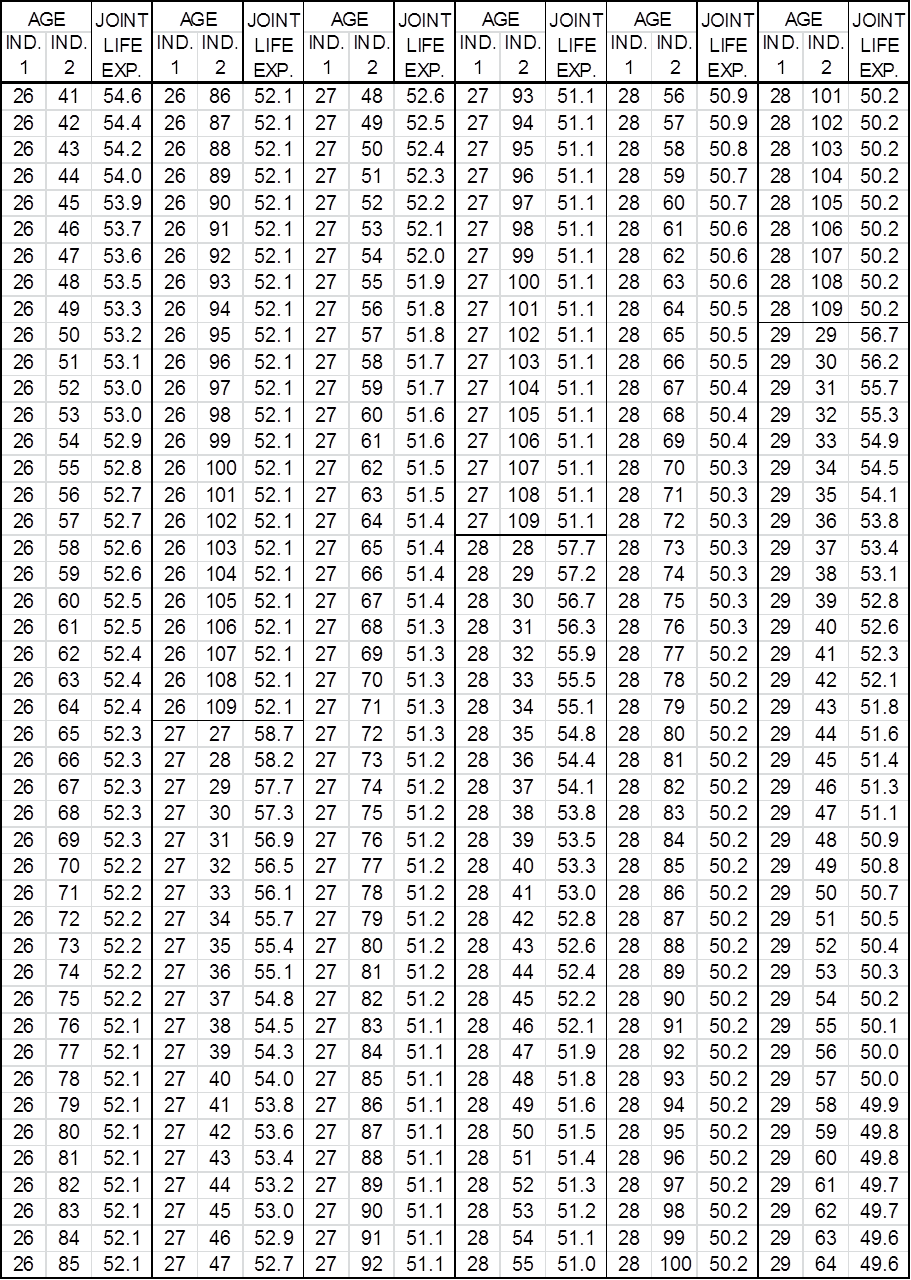

Table 2: Two Life Expectancies Based on 2000 CM Mortality

| 42.4.2801 | DEFINITIONS |

This rule has been repealed.

| 42.4.2802 | HEALTH INSURANCE FOR UNINSURED MONTANANS CREDIT |

This rule has been repealed.

| 42.4.2803 | DETERMINING NUMBER OF EMPLOYEES |

This rule has been repealed.

| 42.4.2902 | COMPUTATION OF THE TAX CREDIT FOR THE PRESERVATION OF HISTORIC PROPERTIES |

(1) Montana's tax credit for the preservation of historic buildings is to be computed using the federal credit allowed by 26 USC 47, which is a component of the federal general business credit. No other component of the federal general business credit may be used to compute Montana's credit for the preservation of historic buildings.

(2) Qualifying expenditures used to calculate the credit for the preservation of historic buildings must be reduced by amounts used in calculating other Montana tax credits or tax incentives.

| 42.4.2903 | COMPUTATION OF TAX CREDIT FOR PRESERVATION OF HISTORIC PROPERTY FOR MARRIED TAXPAYERS |

(1) If property qualifying for the credit is owned by a husband and wife, the credit may be applied to their joint tax liability if filing a joint tax return.

(2) If husband and wife file separately, and the property is jointly held, the credit must be computed individually by each spouse and applied to the corresponding tax liabilities.

(3) When filing separately, one spouse's credit cannot be applied to the other spouse's tax liability.

(4) Carryovers of unused preservation credit may only be applied to the tax liability of the spouse who is entitled to claim the credit. If in a carryover year husband and wife who previously filed separately, now file a joint return, carryover credits must be applied separately to each spouse's share of the joint tax liability.

| 42.4.2904 | OWNERSHIP OF HISTORIC PROPERTY |

(1) The credit is allowed to owners of the property who make qualified rehabilitation expenditures.