Printer Friendly Version

Printer Friendly Version Printer Friendly Version

Printer Friendly Version| 42.19.101 | MARSHALL VALUATION SERVICE |

This rule has been repealed.

| 42.19.102 | COMMERCIAL APPRAISAL FIRMS |

| 42.19.103 | MONTANA APPRAISAL MANUAL |

This rule has been repealed.

| 42.19.201 | DETERMINATION OF PRINCIPAL RESIDENCE |

This rule has been repealed.

| 42.19.202 | APPLICATION DEADLINE |

This rule has been repealed.

| 42.19.301 | CLARIFICATION OF EXCEPTION TO TAX LEVY LIMIT |

This rule has been repealed.

| 42.19.401 | PROPERTY TAX ASSISTANCE PROGRAM (PTAP) AND MONTANA DISABLED VETERAN (MDV) PROPERTY TAX ASSISTANCE PROGRAM |

(1) The property owner of record or the property owner's agent must make application to the local department office to receive the PTAP benefit provided for in 15-6-305, MCA, or the MDV benefit provided for in 15-6-311, MCA.

(2) The PTAP benefit is administered through a reduced property tax rate that applies to the first $200,000 or less of the appraised value of the applicant's residential real property. The MDV benefit is administered through a reduced property tax rate that applies to the residential real property of a qualified veteran or qualified veteran's spouse as provided for in 15-6-301 and 15-6-311, MCA.

(a) The reduced property tax rate does not apply to separately described or assessed parcels of land that do not support the primary residential improvements, regardless of whether those parcels of land are contiguous with or adjacent to the primary residential property.

(b) If the primary residence is a mobile or manufactured home that is assessed separately from the land upon which it is located, both the mobile or manufactured home and the land upon which it is located may qualify for the benefit if they are both owned by the applicant. If the land is not owned by the applicant, the benefit applies only to the mobile or manufactured home. To be eligible, the property must be:

(i) owned by the applicant; or

(ii) under contract for deed; and

(iii) used as the applicant's primary residence.

(3) A taxpayer's primary residence is a dwelling in which the taxpayer can demonstrate they lived at least 7 months of the year for which the assistance is claimed. The primary residence must be the only residence for which the taxpayer claims property tax assistance in a given tax year. The department will apply the full year benefit to the primary residence when:

(a) a qualifying applicant owns and occupies the primary residence at the time the tax roll is provided to the county treasurer for billing. If the property ownership changes between that time and the end of the calendar year, the benefit remains on the property for the full tax year; or

(b) in the case of a separately assessed mobile or manufactured home, a qualifying first time applicant receives a classification and appraisal notice from the department and applies for the property tax assistance within 30 days from the date on the notice affirming that their home is their primary residence.

(4) If a qualifying applicant owns and lives in one Montana dwelling for less than 7 months during the tax year, and in another Montana dwelling for less than 7 months of the same tax year, the time in both dwellings can be combined to meet the 7-month requirement. When a change in the property ownership occurs prior to the time the tax roll is provided to the county treasurer's office for billing, the department will apply the benefit as follows:

(a) if a qualifying applicant owned and occupied the property for less than 7 months of the tax year, the department will remove the benefit from the property. The benefit may be transferred to another primary residence, if the qualifying applicant purchases one, as provided in 15-6-301, MCA; or

(b) if a qualifying applicant owned and occupied the property for at least 7 months of the tax year, the department will apply the benefit for the number of days that the qualifying applicant owned and occupied the property, based on the date of sale. The property will be assessed at the full tax rate for the portion of the year following the date of sale.

(5) An applicant may demonstrate the 7-month occupancy requirement in (4) with such indicators including, but not limited to:

(a) the mailing address for receipt of bills and correspondence;

(b) the address on file with the applicant's employer as the place of residence; and

(c) the mailing address listed on the applicant's federal and state tax returns, driver's license, car registration, hunting and fishing licenses, or voter registration.

(6) A temporary stay in a nursing home or similar facility will not change an applicant's primary residence for the purposes of the PTAP or MDV benefits.

(7) The benefit does not transfer to the new owner of the dwelling.

(8) A property owner of record or the property owner's agent must file an application that is postmarked by April 15 of the year for which the assistance is first claimed. Applications received after that date will be processed and entered into the department's income and eligibility verification process for the following year.

(9) The department may accept applications through regular or electronic mail, in person, or by telephone. If by telephone, the employee shall verify that the applicant has affirmed their eligibility and affirmed that the dwelling is their primary residence by signing the form on the applicant's behalf and initialing the signature.

(10) An applicant is not required to reapply once the department has entered their application into its verification process except as provided in (3) and (4).

(11) The April 15 application deadline is waived if a first-time applicant forwards an application to the department within 30 days from the date on the classification and appraisal notice.

(12) The department may waive the April 15 application deadline at any time the department's local office or the department's taxpayer advocate consults with local aging services or disability offices and confirms a hardship case exists. The department must document its finding.

(13) The department may coordinate with the Social Security Administration and the Veterans Affairs Administration to verify the income and eligibility of applicants and participants.

(14) Each year the department will:

(a) verify the qualifying income and eligibility of applicants and participants;

(b) grant or deny the applicant's benefit;

(c) advise applicants and participants of the department's determination in writing; and

(d) advise taxpayers of their right to appeal the department's determination to the Montana Tax Appeal Board within 30 days of receiving a determination letter.

(15) The information applicants provide the department is subject to the false swearing penalties established in 45-7-202, MCA. The department:

(a) may investigate the information provided in an application and an applicant's continued eligibility;

(b) may request an applicant to verify the occupancy of their primary residence; and

(c) will review, on a case-by-case basis, any applicant or participant for whom its verification process finds no source of income and record its findings for future use.

(16) The department may address unusual circumstances of ownership and income that arise in administering this program such as:

(a) confusion when a spouse dies and the other spouse is not yet on the property's deed; or

(b) one-time increases in income used for funeral or medical expenses.

| 42.19.402 | INFLATION ADJUSTMENT FOR PROPERTY TAX ASSISTANCE PROGRAM (PTAP) AND FOR MONTANA DISABLED VETERAN (MDV) PROPERTY TAX ASSISTANCE PROGRAM |

(1) Sections 15-6-301, 15-6-305, and 15-6-311, MCA, provide property tax relief to fixed or limited income homeowners, qualified disabled veterans, and qualified veterans' spouses. Sections 15-6-302, 15-6-305, and 15-6-311, MCA, also require the department to annually adjust the income levels used to determine the eligibility and the amount of relief to account for the effects of inflation.

(2) The calculation of the inflation factor shall be made on a yearly basis as follows:

(a) Sections 15-6-301, 15-6-305, and 15-6-311, MCA, specify that the implicit price deflator (price index) for personal consumption expenditures (PCE), published in the national income and product accounts by the Bureau of Economic Analysis of the U.S. Department of Commerce, is to be used in the calculation of the inflation factor.

(b) The formula for the calculation of the inflation factor is as follows:

PCE (t-1)

IFt = ---------

PCE t o

where:

IFt equals the inflation factor for property tax year t,

PCE (t-1) is the price index value for personal consumption expenditures for the first quarter of the year prior to the tax year in question,

PCE t o is the price index value for personal consumption expenditures for the first quarter of 2015.

(c) The inflation factor, calculated per the previous section, is used to annually adjust the base year income schedules for the effects of inflation.

Each income figure in the base year income schedule is multiplied by the inflation factor calculated for the tax year in question in order to update the schedule. The product is then rounded to the nearest whole dollar amount. If the adjustment results in a decrease in qualifying income levels from the previous year, the qualifying income levels must remain the same for that year.

(3) The base year income levels for PTAP and MDV are provided in 15-6-305 and 15-6-311, MCA, respectively.

| 42.19.403 | MONTANA DISABLED VETERAN (MDV) PROPERTY TAX ASSISTANCE PROGRAM |

This rule has been repealed.

| 42.19.404 | INFLATION ADJUSTMENT FOR MONTANA DISABLED VETERAN (MDV) PROPERTY TAX ASSISTANCE PROGRAM |

This rule has been repealed.

| 42.19.405 | DEFINITIONS |

The following definitions apply to rules in this subchapter.

(1) "Head of household" means a taxpayer who meets the head of household standard for federal income tax purposes.

(2) "Percentage reduction" means the amount by which the property tax rate is reduced based on the income schedules for the property tax assistance program (PTAP) and for the Montana disabled veteran (MDV) property tax assistance program. Those schedules are located in ARM 42.19.402.

(3) "Qualifying applicant" means:

(a) an individual who is the record owner of the land and improvements that are the primary residence of the individual; or

(b) a revocable trust if the land and improvements are the primary residence of the grantor.

(c) Ownership interests that are not qualifying applicants include, but are not limited to, partnerships, corporations, limited liability corporations, transferrable revocable trusts, and irrevocable trusts.

(4) "Qualifying income" means the federal adjusted gross income of an applicant and an applicant's spouse, excluding capital and income losses as they appear on their Montana income tax return for the prior tax year.

(a) If the applicant did not file a Montana income tax return for the applicable year, qualifying income means the federal adjusted gross income of the applicant and the applicant's spouse, excluding capital income losses as they appear on their federal income tax return, for the applicable year.

(b) If the applicant does not have an income tax filing requirement, the applicant's qualifying income is considered to be zero.

(5) "Residential real property" means the land and improvements of a taxpayer's primary residence.

| 42.19.406 | EXTENDED PROPERTY TAX ASSISTANCE PROGRAM (EPTAP) |

This rule has been repealed.

| 42.19.407 | INTANGIBLE LAND VALUE PROPERTY TAX ASSISTANCE PROGRAM FOR RESIDENTIAL PROPERTY |

(1) Property taxpayers meeting the requirements of the intangible land value property tax assistance program, as described in 15-6-240, MCA, may submit an application for assistance to the department. The application form is available on the department's web site at revenue.mt.gov.

(2) Applications must be submitted by March 1 in order to be considered for the current tax year as provided in 15-6-240, MCA.

(3) Qualifying applicants shall affirm that the property owned and maintained by the applicant is the applicant's primary residence. If verification is necessary, the applicant may demonstrate they meet this requirement with such indicators including, but not limited to:

(a) the mailing address for receipt of bills and correspondence;

(b) the address on file with the applicant's employer as the place of residence; or

(c) the mailing address listed on the applicant's federal and state tax returns, driver's license, car registration, hunting and fishing licenses, or voter registration.

(4) Qualifying applicants must provide documentation that the land for which the applicant is seeking assistance has been owned by the applicant or a family member of the applicant within three degrees of consanguinity (ancestral line of descent) for at least 30 consecutive years. Acceptable types of documentation include, but are not limited to:

(a) property deeds showing ownership of the land;

(b) property tax records indicating ownership in the name of the applicant;

(c) bills of sale indicating ownership in the name of the applicant; or

(d) documents showing the transfer of the land from one degree of consanguinity to the next degree.

(5) Computation of the degree of consanguinity is calculated as follows:

(a) The degree of relationship by consanguinity between an individual and the individual's descendant is determined by the number of generations that separate them.

(b) If an individual and the individual's relative are related by consanguinity, but neither is descended from the other, the degree of relationship is determined by adding:

(i) the number of generations between the individual and the nearest common ancestor of the individual and the individual's relative; and

(ii) the number of generations between the relative and the nearest common ancestor.

(c) An individual's relatives within the third degree of consanguinity are the individual's:

(i) parent or child (relatives in the first degree);

(ii) brother, sister, grandparent, or grandchild (relatives in the second degree); and

(iii) great-grandparent, great-grandchild, aunt who is a sister of a parent of the individual, uncle who is a brother of a parent of the individual, nephew who is a child of a brother or sister of the individual, or niece who is a child of a brother or sister of the individual (relatives in the third degree).

(6) As described in 15-6-240, MCA, if the department's appraised value of the land is greater than 150 percent of the appraised value of the primary residence and improvements situated on the land, then the land is valued at 150 percent of the appraised value of the primary residence and improvements, subject to the following:

(a) The subject property will not qualify if the land value is less than the statewide average of the land multiplied by the acreage of land of the subject property.

(b) Parcels of land exceeding five acres in size do not qualify unless the department's appraised value of the first five acres which support the primary residential improvements is greater than 150 percent of the appraised value of the primary residence and improvements situated on the land. In such cases, any land in excess of five acres remains valued at its market value.

(7) For the purpose of administering (6), the department determines the statewide average value of land to be the average market value per acre of all taxable class four residential land that is valued using the acre market land valuation models. The average market value per acre is calculated by taking the total appraised value of all taxable class four residential land valued using the acre land valuation models divided by the total acreage of all taxable class four residential land valued using the acre land valuation models.

(8) Qualifying applicants are required to reapply for the intangible land value property tax assistance program each property valuation cycle. The supporting documentation outlined in (4) may be required with reapplications.

| 42.19.501 | PROPERTY TAX EXEMPTION FOR QUALIFIED DISABLED VETERANS |

This rule has been transferred.

| 42.19.502 | EXEMPTIONS INVOLVING AN OWNERSHIP TEST |

(1) A tribal member who owns vehicles and other personal property in whole or in part is subject to the provisions of this rule. The following requirements apply to tribal personal property in order to meet the ownership test:

(a) The exemption applies to tribal members living on the reservation of the tribe in which they are an enrolled member;

(b) If the tribal member owns 100 percent of the interest in personal property (such as vehicles), the property is 100 percent exempt; and

(c) If the personal property is jointly owned by tribal members and nontribal members and there is no indication of the percentage of ownership for each owner, the exemption of the property is prorated among the owners as if each owner owned equal interests in the property. An example of this is when a tribal member and two nontribal members register a vehicle. The vehicle is on the reservation of the tribal member and there is no indication of the percentage of ownership for each owner. The vehicle receives a 33 percent exemption and is taxed for the remaining 67 percent.

(d) If there is an indication of percentage of ownership, the exemption will be prorated based on the indicated percentages. For motor vehicles, the percentage of ownership must be proven by submittal of a current title or registration indicating the percentage of ownership. For other personal property, the percentage of ownership can be proven by submittal of a bill of sale or an affidavit, signed by all owners, indicating each owner's percentage of ownership.

(2) The following requirements apply to tribal real property in order to meet the ownership test:

(a) The exemption involving an ownership test applies to real property located on the reservation in which the tribal member is an enrolled member. In most cases the percentage of ownership is stated on the deed or instrument that transfers intention that the land be subject to state taxation, or if the land is held by the United States government in trust for the enrolled member, it is not generally taxable and is exempt.

(b) Property acquired under a federal statute in which Congress expressed its intention that the land be subject to state taxation, such as the Indian General Allotment Act of 1887, is not entitled to an exemption and will remain on the tax roll, unless it was placed in trust after acquisition under the particular federal statute. If the local staff cannot determine whether the property was acquired under a federal statute authorizing state taxation or is held in trust by the United States, the property will be placed on the tax roll until the owner can produce proof that the property is entitled to an exemption. Therefore, if the tribal member owns 20 percent of the property and is entitled to an exemption, 20 percent of the property will receive an exemption and the remaining 80 percent of the property will remain on the tax roll. The assessment will be addressed to and sent to the nontribal member(s).

(3) Military personnel who own vehicles and other personal property in whole or in part are subject to the provisions of this rule.

(a) If a military person is entitled to an exemption for that person's personal property under the Soldiers and Sailors Relief Act, the amount of exemption will depend on their percentage of ownership. If there are owners other than the military person and the ownership document does not indicate the ownership interest, the property must be prorated among the owners as if each owner owned equal interests in the property. For example, if a vehicle is owned by a military person and his/her spouse and there is no legal indication of the percentage of ownership, the vehicle would receive a 50 percent exemption.

(b) To receive an exemption under the Soldiers and Sailors Relief Act, the military person must be a nonresident and provide the department with proof that they have orders assigning them to duty in Montana.

(c) There is no exemption allowed for real property of active military personnel or personal property used in or arising from a trade or business of the active duty military personnel.

(4) For other types of exemptions that require an application for exemption and an ownership test to qualify, the exemption is based on the percentage of ownership as contained in the document that evidences ownership, and on whether or not the property satisfies the use test required by the exemption statute (if a use test is required). If the document does not show the ownership interest, the value of the property must be prorated among the owners as if each owner owned equal interests in the property. An example would be if a church and a pastor are both listed as owners of a house. The house is occupied by the pastor and he is a member of the clergy. The church's 50 percent interest is exempt from taxation. The pastor's 50 percent interest is not exempt from taxation. This portion of the rule applies to properties which receive an exemption under 15-6-201, 15-6-203, 15-6-209, MCA.

| 42.19.503 | INFLATION ADJUSTMENT FOR QUALIFIED DISABLED VETERAN PROPERTY TAX EXEMPTION PROGRAM |

This rule has been transferred.

| 42.19.506 | EXEMPTIONS INVOLVING A USE TEST |

(1) For property tax exemptions which require a use test, the following criteria apply:

(a) the applicant must state the actual or proposed use of the property in the form of an affidavit or letter;

(b) the applicant shall provide supporting documentation for the stated actual or proposed use of the property;

(c) examples of supporting documentation include, but are not limited to:

(i) site plans;

(ii) soil surveys;

(iii) building permits;

(iv) sewer permits;

(v) environmental studies;

(vi) requests for zoning changes;

(vii) architectural planning;

(viii) grant applications for construction; and

(ix) physical inspections of the property by the local Department of Revenue staff; and

(d) the ratio of the exempt to nonexempt use is used to determine the portion of the property that will receive the exemption.

(2) The documentation shall be sufficient to demonstrate that the property is either currently in, or will be put to, the stated use within a reasonable time period.

(3) An example of the application of the use test in (1) is when 25 percent of a building was used for educational purposes in the current year and the remainder of the building was used for commercial purposes. The applicant owns the property on January 1 and applies for an exemption on March 1 of the current year. For the current year and until the use changes, the property receives a 25 percent exemption for the land and the building.

(4) If the use of a property that is exempt because it has met a prior use test changes during the year, the exemption for the property is reviewed and the exemption adjusted accordingly on January 1 of the tax year following the change in use.

(5) This rule applies to exemptions that require an application for exemption, which includes properties listed in 15-6-201, 15-6-203, and 15-6-209, MCA.

| 42.19.601 | NOTIFICATION OF CLASSIFICATION AND APPRAISAL TO OWNERS OF MULTIPLE UNDIVIDED OWNERSHIPS |

(a) first surname alphabetically;

(b) surname holding the largest percent of ownership; or

(c) surname of the person with the most reliable address.

(2) As subsequent ownership changes occur to a multiple undivided ownership parcel, after April 30, 2001, the department will use the surname and address of the first cotenant listed on the recorded document.

(3) Any cotenant not designated as a recipient may request a copy of the assessment information from the department.

| 42.19.1101 | CAPITAL INVESTMENT IN NONFOSSIL FORMS OF ENERGY GENERATION |

This rule has been transferred.

| 42.19.1102 | TREATMENT OF GASOHOL PRODUCTION FACILITIES |

(1) Gasohol production facilities' personal or real property may qualify as class five property as defined in 15-6-135 , MCA, during construction and for the first three years of operation.

| 42.19.1103 | TREATMENT OF ETHANOL MANUFACTURING FACILITIES |

(1) Ethanol manufacturing facilities' manufacturing machinery, fixtures, equipment, and tolls used for the production of fuel grade ethanol from grain during the course of the construction and for ten years after initial production of fuel grade ethanol are exempt from property taxation.

(2) Initial production is defined as the commencement of operations, which is defined in ARM 42.19.1212.

| 42.19.1104 | PROPERTY TAX EXEMPTION FOR NONFOSSIL ENERGY SYSTEM |

(1) The property owner of record, or the property owner's agent, must make application to the local department office for classification as a nonfossil form of energy generation on a form available on the department's website or from the local department office before March 1 to be considered for exemption for the current tax year.

(2) When a completed application is received by the local department field office, the department staff will adhere to the following procedures:

(a) The energy system will be inspected and the application considered in time to assure that any exemption will affect the property's value in the earliest possible tax year following the date of application.

(b) If the energy system is completed prior to March 1 of a year, the application must be filed by March 1 of that year in order for an exemption to apply for the full ten-year period.

(c) If the energy system is completed after March 1 of a year, the application must be filed by March 1 of the next year in order for an exemption to apply for the full ten-year period.

(d) If an applicant misses the deadlines outlined above, they will lose one year of exemption potential for every deadline date that passes. For example:

(i) If an individual completes installation of an energy system in August of the current year, but does not apply for an exemption by March 1 of the next year, the exemption would be allowed for a total of nine years.

(ii) If the individual completes installation of an energy system in July of the current year, but does not apply for an exemption until two years later, the individual has a total exemption potential of eight years.

(e) The maximum exemption for residential property is $20,000 in market value as determined by the department and for nonresidential property, it is $100,000 in market value as determined by the department. If the value of the energy system appears to exceed those amounts, the property data and exemption application will be reviewed for consideration by the department. Any market value over $20,000 for residential property or $100,000 for nonresidential property will not receive the exemption.

(3) The following criteria must be satisfied in order for any energy system to receive exemption (all criteria must be satisfied for successful application):

(a) The system must be able to generate energy by use of "recognized nonfossil" means.

(b) The system's components must be unique to the system and not standard components of the structure for which it provides energy.

(c) The predominant use of the system must be energy generation.

| 42.19.1201 | TREATMENT OF AGRICULTURAL PROCESSING |

(2) Agricultural processing property is eligible for treatment as new industrial property.

| 42.19.1202 | TREATMENT OF PROPERTY NOT USED AS PART OF THE NEW INDUSTRY |

(1) In order to qualify as new industrial property, the property in question must be used by the new firm in a qualifying activity at all times during the three-year exemption period. Land held for future use or for nonindustrial use is excluded from classification as new industrial property. Only property used directly in the qualifying activity may qualify. Property used in a supplementary fashion, such as a housing development in conjunction with an industrial plant, does not qualify.

(2) Raw materials, in-process, and finished product "business inventories" are not considered new industrial property and are exempt from property taxation under 15-6-202 , MCA. Similarly, all materials, supplies, and merchandise held for sale or used by a new industrial plant are not considered to be new industrial property.

| 42.19.1203 | TREATMENT OF AIR AND WATER POLLUTION CONTROL EQUIPMENT |

(1) Air and water pollution control plant property and equipment, as defined in 15-6-135 , MCA, is not considered to be new industrial property but is already treated as taxable class five property under the provisions of 15-6-135 , MCA.

(2) In order to receive taxable class five classification under 15-6-135 , MCA, a new industry installing pollution control plant property and equipment must apply to and receive pollution control certification from the Department of Environmental Quality.

(3) To be eligible to receive pollution control status for the current tax year, the application must be received by the Department of Environmental Quality on or before January 1 of that year.

| 42.19.1204 | TREATMENT OF MOTOR VEHICLES |

| 42.19.1205 | DEFINITIONS |

(1) "Value added" means an increase in the worth of the product being produced and not merely an increase in existing production. The tax incentive is limited to manufacturing machinery and equipment involved in the value added process. If the department determines that manufacturing machinery and equipment qualifies for the tax incentive, the application must still be approved by the governing body of the local taxing jurisdiction.

| 42.19.1211 | PERIOD OF CLASSIFICATION AS NEW INDUSTRIAL PROPERTY |

(1) The taxable classification of all qualifying new industrial property becomes effective beginning on the first assessment date on or after the initial commencement date of operations.

(2) The new industrial property taxable classification runs for three consecutive years after commencement of operations. This period runs to its expiration date uninterrupted by additions of property to the new industry endeavor, expansion of operations, changes of operations (other than changes that would disqualify the new industry endeavor from classification as new industrial property) or cessation or curtailment of operations.

(3) Prior to and after the three-year period of classification as new industry property, the property in question is taxable as other similar property.

(4) For all property other than migratory personal property, the taxable year is considered to be the calendar year. The assessment date within any given calendar year is January 1.

(5) For migratory personal property that enters Montana after the regular assessment date and comes to rest and becomes a part of the general property within any county of the state, the assessment date is the date the property originally entered the state. This property shall be taxed from the time it enters the state until the end of the year. For purposes of assessment year proration on this migratory personal property, any part of a month is considered a month of residency.

| 42.19.1212 | COMMENCEMENT OF OPERATIONS |

(2) Initial test batch runs for machinery adjustment purposes are considered part of the initial cost of installing the machinery in the production process and does not constitute production.

| 42.19.1213 | CHANGES IN OPERATIONS |

(2) Classification as new industry property ceases upon sale; transfer; change of possession; or other change in ownership, possession, or control of such property, unless prior to such action, application is made by the transferee for continuation as new industry property and the application is granted by the department. The loss of classification as new industry property does not apply to transactions such as the mortgaging of the property or otherwise using the property as security when there is no change in ownership or possession.

(3) If a qualified new industry ceases to operate as a new industry under the provisions of 15-6-135 , MCA, the classification as new industry property terminates.

(4) If a qualified new industry ceases to operate, either temporarily or permanently, the three-year period continues until its normal expiration date, regardless of subsequent commencement of new operations. Once a date is established it cannot be modified. Following cessation of operation, an application for classification as new industrial property may not be granted unless the new operation is substantially different from the former operation.

| 42.19.1220 | TAX INCENTIVE FOR NEW AND EXPANDING INDUSTRY |

This rule has been transferred.

| 42.19.1221 | OPINION LETTERS |

(2) This opinion is based solely on the written material submitted for review and is subject to revision upon review of the formal application.

| 42.19.1222 | APPLICATION FOR SPECIAL CLASSIFICATION |

(2) The application shall contain as a minimum the following information:

(a) the exact name of each applicant;

(b) the date of incorporation, organization, or formation of the applicant and the name of the state or other jurisdiction under the laws of which the applicant was incorporated, organized, or formed unless the applicants are individuals, and if the applicants are individuals then the current address of each such individual;

(c) if a foreign corporation, the date upon which qualified with the Secretary of State OF MONTANA;

(d) the principal place of business and principal business address of the applicant and the principal place of business and business address of the contemplated new industry endeavor;

(e) the name of each county in which the new industry is located or to be located;

(f) a complete list of all properties (perspective properties) of the applicant within the state OF MONTANA for which application is made, giving the legal description of all real property and describing with certainty the personal property and the location thereof, including the original cost and date of acquisition of personal property;

(g) a detailed description of the industrial activities or operation contemplated by the applicant;

(h) a complete list of the officers, directors, trustees, stockholders, investors, partners, managers, or others having control of, investment in, or substantial interests in the new industrial endeavor, together with the current address of each such person, firm, or corporation;

(i) the name and address of each person, firm, or corporation from which the applicant has or intends to acquire property for use in its qualifying operation and for which application is made or for which the application if granted will afford classification as new industry property;

(j) an exact description of the nature of the business (prospective business) , economic, or industry operations or activities conducted by the applicant, related persons or business units, or any controlling officers, directors, incorporators, partners, shareholders, investors, or any predecessor thereof;

(k) the date upon which it is contemplated that the operations of the new industry undertaking of the applicant, for which application is made, will commence.

(l) applicants qualifying for new industry classification pursuant to 15-6-135 , MCA, shall include as part of the application:

(i) copies of existing financial statements, income statements and sales information showing where sales occur and where receipts are earned by state if completed for any fiscal period which covers any portion of the assessment year for which the new industry classification is sought;

(ii) a certification by the chief financial officer for the applicant that it is anticipated the applicant will meet the requirements of 15-6-135 , MCA, during the assessment year for which classification as new industry is sought;

(iii) certification by the chief financial officer that the applicant will provide copies of financial statements, income statements and sales information showing where sales occur and where income and receipts are earned by state as soon as they are completed at the close of the applicant's fiscal year for any fiscal year which covers any portion of the assessment year for which classification as new industry is sought;

(iv) a certification by the chief financial officer that if the applicant does not meet the requirements of 15-6-135 , MCA, the applicant will pay the taxes which would have been due without the new industry classification (plus interest) .

(3) The department may at any time call for such other or supplementary information or matter as it considers necessary.

(4) In addition, all applicants shall attach to the application and as an exhibit thereto, the following:

(a) a current assessment sheet on the form prescribed and used by the county appraisal/assessment office in each county in which such property is located or to be located, showing all of the properties in that county which are the subject of such application;

(b) a statement that the applicant will immediately furnish to the department and each affected county appraisal/assessment office a detailed written report of any change of a material nature in either its operations or the extent or nature of its properties at any time during the three-year special classification period, should such classification be granted, or any other information or matter the department shall, in writing, request.

(5) The application is to be signed by each applicant or in the case of a business entity, by a principal officer.

| 42.19.1223 | PROCESSING OF APPLICATION |

(2) The department decision on the application is made in writing and sent to the applicant. An applicant who is dissatisfied with the department's decision may appeal to the State Tax Appeal Board.

(3) The department's final decision on the application is sent to each affected county appraisal/assessment office.

| 42.19.1224 | ADVERSE IMPACTS |

| 42.19.1235 | TAX INCENTIVE FOR NEW OR EXPANDING INDUSTRY |

(1) An applicant must make application to the governing body of the affected taxing jurisdiction on a form provided by the department. The form shall include, among other information, a specific description of the improvement or modernized process for which specialized tax treatment is requested, the date when construction or installation is to commence or has commenced and the date when it is to be completed. The governing body of the affected taxing jurisdiction must approve the application and pass an approving resolution before tax benefits under 15-24-1402, MCA, can be received.

(2) In order to be considered for the current tax year, an application must be filed on the form available from the department on or before March 1 of the tax year.

(3) The applicant must notify the department by sending a copy of the approved application described in (1) within 30 days after receiving approval from the affected taxing jurisdiction.

(4) The preceding year and current year's additions and investments may be considered and included for purposes of determining whether the threshold investment levels specified in 15-24-1401, MCA have been met.

(5) The department shall appraise the applicant's property after expansion or modernization.

(6) Only the increased value attributed to the expansion or modernization will receive tax incentives under 15-24-1402, MCA.

(7) An applicant's property that qualifies for classification as new industrial property under 15-6-135, MCA, cannot qualify for a tax incentive pursuant to 15-24-1402, MCA, as new or expanding industry property defined in 15-24-1401, MCA.

(8) Additional expansion or modernization of property constructed in tax years subsequent to an expansion approved for tax incentives under 15-24-1402, MCA, does not qualify for an additional tax incentive unless an additional application is filed and an approving resolution passed.

(9) An applicant seeking to qualify pursuant to 15-24-1401, MCA, shall include the same information and certifications as required by ARM 42.19.1222.

| 42.19.1240 | TAXABLE RATE REDUCTION FOR VALUE ADDED PROPERTY |

This rule has been repealed.

| 42.19.1301 | DEFINITIONS |

This rule has been repealed.

| 42.19.1302 | FORM |

This rule has been repealed.

| 42.19.1401 | DEFINITIONS |

The following definitions apply to this subchapter:

(1) "Levy district" means a geographically distinct area where all of the properties are subject to the same combination of taxing jurisdiction's mill levies. Levy districts are created for administrative purposes and do not have any taxing authority.

(2) "Targeted economic development district (TEDD)" means a district created pursuant to 7-15-4279, MCA, that contains a provision for tax increment financing as provided for in 7-15-4282, MCA.

(3) "Tax increment financing district (TIFD)" means the area within the external boundaries of an urban renewal district (URD) or a targeted economic development district (TEDD) that:

(a) has been legally created pursuant to the provisions of 7-15-4282, MCA; and

(b) contains a provision for the use of tax increment financing.

(4) "Taxing jurisdiction" means a government entity authorized to impose tax on property. A taxing jurisdiction may include the properties in one or more levy districts.

(5) "Urban renewal district (URD)" means a district created pursuant to 7-15-4202 through 7-15-4218 and 7-15-4280 through 7-15-4284, MCA, that contains a provision for tax increment financing as provided for in 7-15-4282, MCA.

(6) "Value-adding economic projects" means projects that, through the employment of knowledge or labor, add value to industrial or technological products, processes, or export services resulting in the creation of new wealth.

(a) Value-adding economic projects include projects:

(i) that mechanically or chemically transform materials or substances into new products in the manner defined as manufacturing in the North American Industry Classification System Manual prepared by the United States Office of Management and Budget; and

(ii) that, through a technological process, transform materials, substances, or information into new products.

(b) Value-adding economic projects do not include projects undertaken by service-based businesses or industries including, but not limited to, hotels, restaurants, automobile dealerships, and other similar businesses or industries.

(c) Nothing in this section precludes service-based businesses or industries from being located within a targeted economic development district (TEDD), provided the primary purpose of the TEDD is the development of infrastructure to encourage the location and retention of value-added economic projects.

| 42.19.1402 | NOTIFICATION OF THE CREATION OR AMENDMENT OF A TAX INCREMENT FINANCING DISTRICT - TIMING |

This rule has been repealed.

| 42.19.1403 | NOTIFICATION REQUIREMENTS FOR THE CREATION OR AMENDMENT OF AN URBAN RENEWAL DISTRICT (URD) WITH A TAX INCREMENT FINANCING PROVISION |

(1) A local government may create or amend a URD containing a tax increment financing provision pursuant to Title 7, chapter 15, parts 42 and 43, MCA.

(2) Before the department can certify the base taxable value of property located within a newly created or amended district, the local government must notify the department of the intent to create or amend a URD containing a tax increment financing provision. The notification must include:

(a) the contact information for the person designated to interact with the department;

(b) the name of the district;

(c) the desired base year;

(d) a legal description accompanied by a map illustrating the district's proposed boundary;

(e) GIS data files that include locational information in the form of coordinates, points, lines, polygons, etc., if available; and

(f) confirmation that the property within the proposed district is contiguous and not included within an existing URD or TEDD district.

(3) If the local government wants the department to provide a list of the affected real, separately assessed improvements, personal and centrally assessed properties within the district, the local government must provide the notification information required in (2)(a) through (c), and preliminary versions of the notification information described in (2)(d) and (e), to the department no later than August 1 of the desired base year. Within 60 days after receiving the notification, the department will provide the following to the designated contact:

(a) confirmation that no issues were identified with the preliminary district boundary; and

(b) a list of the affected properties.

(4) If the local government does not need the department to provide a list of the affected real, separately assessed improvements, personal and centrally assessed properties within the district, the local government must provide the notification information required in (2)(a) through (c), and preliminary versions of the notification information described in (2)(d) and (e), to the department no later than December 1 of the desired base year.

(5) By no later than February 1 of the calendar year following the creation of the district, the local government must provide the department with the following:

(a) final versions of the notification information described in (2)(d) and (e), if not previously provided;

(b) a copy of the executed resolution of necessity required by 7-15-4210, MCA. The executed resolution must contain:

(i) an effective date prior to the date on which the URD is created;

(ii) the finding of blight, as required by 7-15-4210(1), MCA; and

(iii) a statement of necessity regarding the interest of public health, morals, or welfare of the residents, as required by 7-15-4210(2), MCA;

(c) a copy of the local governing body's resolution adopting the growth policy pursuant to 76-1-604, MCA;

(d) a copy of the municipality's planning commission's written recommendation to the local governing body that the urban renewal plan conforms with the local government's growth policy that attaches:

(i) supporting documentation upon which the conformance is based; and

(ii) supporting documentation upon which the exercise of a local governing body's zoning powers is based;

(e) if the documentation in (d) is not available, a copy of the document affirming that the local governing body received no written recommendation from the planning commission and scheduled the public hearing on the urban renewal plan as permitted in 7-15-4214, MCA;

(f) a copy of the published notice of public hearing required under 7-15-4215, MCA;

(g) a copy of the letter that was sent to all property owners in the district;

(h) a list of all addresses to which a copy of the letter was sent;

(i) a list of all the geocodes, assessor codes, and centrally assessed property within the district;

(j) a copy of the local government's urban renewal plan pursuant to 7-15-4212 and 7-15-4216, MCA, containing the tax increment provision under 7-15-4216, MCA; and

(k) a copy of the ordinance adopting the urban renewal plan with the tax increment provision; pursuant to 7-15-4216 or 7-15-4284, MCA.

(6) Within 20 business days after the department receives the documentation required in (2) and (5), the department will send notification to the local government whether the documentation is complete and correct for the desired base year.

(a) If supporting documentation submitted with the application is deficient, the department will notify the local government and request additional information.

(b) By March 1, the department must receive the local government's complete and corrected documentation to establish a base year effective January 1 of the previous year.

(c) If supporting documentation submitted with the application is complete and correct, the department will notify the local government and will report the base, actual, and incremental taxable values to the taxing jurisdictions by the first Monday in August of the calendar year following receipt of the notification in (2).

(d) If supporting documentation submitted for creation or amendment of a URD is not complete and correct, the department will report the base, actual, and incremental taxable values to the taxing jurisdictions by the first Monday in August of the calendar year following the year which the complete and correct supporting documentation is submitted to the department.

(7) All correspondence and documentation must be mailed to the Department of Revenue, Property Assessment Division at P.O. Box 8018, Helena, MT 59604-8018, or e-mailed to DORTIFinfo@mt.gov.

| 42.19.1404 | NOTIFICATION REQUIREMENTS FOR THE CREATION OR AMENDMENT OF A TARGETED ECONOMIC DEVELOPMENT DISTRICT (TEDD) WITH A TAX INCREMENT FINANCING PROVISION |

(1) A local government may create or amend a TEDD containing a tax increment financing provision pursuant to Title 7, chapter 15, parts 42 and 43, MCA. The department will review a local government's urban renewal district (URD) or TEDD processes, documents, and information required under those statutes and these rules to determine fulfillment of a district's purpose and the specific requirements provided under 7-15-4279, MCA, in the department's TEDD taxable value certification process.

(2) Before the department can certify the base taxable value of property located within a newly created or amended district, the local government must notify the department of the intent to create or amend a TEDD containing a tax increment financing provision. The notification must include:

(a) the contact information for the person designated to interact with the department;

(b) the name of the district;

(c) the desired base year;

(d) a legal description accompanied by a map illustrating the district's proposed boundary;

(e) GIS data files that include locational information in the form of coordinates, points, lines, polygons, etc., if available; and

(f) confirmation the property within the proposed district is contiguous and not included within an existing URD or TEDD district.

(3) If the local government wants the department to provide a list of the affected real, separately assessed improvements, personal and centrally assessed properties within the district, the local government must provide the notification information required in (2)(a) through (c), and preliminary versions of the notification information described in (2)(d) and (e) to the department no later than August 1. Within 60 days of receiving the notification, the department will provide the following to the designated contact:

(a) confirmation that no issues were identified with the preliminary district boundary; and

(b) a list of the affected properties.

(4) If the local government does not need the department to provide a list of the affected real, separately assessed improvement, personal and centrally assessed properties within the district, the local government must provide the notification information required in (2) to the department no later than December 1.

(5) By no later than February 1 of the calendar year following the creation of the district, the local government must provide the department with the following:

(a) final versions of the notification information described in (2)(d) and (e), if not previously provided;

(b) a copy of the executed resolution of necessity required by 7-15-4280, MCA. The executed resolution must contain:

(i) an effective date prior to the date on which the TEDD was created;

(ii) the infrastructure deficiency finding, as required by 7-15-4280(1), MCA; and

(iii) a statement of necessity regarding the welfare of the residents, as required by 7-15-4280(1), MCA;

(c) a copy of the local government's finding that the TEDD is zoned either for uses in accordance with the area local growth policy as defined in 76-1-103, MCA, for uses in accordance with the development pattern and zoning regulations, or the development district adopted under Title 76, chapter 2, part 1, MCA, that includes documentation upon which the accordance with zoning is based;

(d) a copy of the resolution adopting the zoning of the district, pursuant to 7-15-4279, MCA;

(e) a copy of the resolution adopting the growth policy, pursuant to 76-1-604, MCA, if applicable;

(f) a copy of the published notice of public hearing required under 7-15-4215, MCA;

(g) a copy of the letter that was sent to all property taxpayers in the district;

(h) a list of all addresses to which a copy of the letter was sent;

(i) a list of all the geocodes, assessor codes, and centrally assessed property within the district;

(j) a copy of the local government's comprehensive development plan for the district pursuant to 7-15-4279 and 7-15-4284, MCA, containing the tax increment provision; and

(k) a copy of the executed ordinance adopting the comprehensive development plan for the district with the tax increment financing provision pursuant to 7-15-4284, MCA.

(6) Within 20 business days after the department receives the required documentation in (2) and (5), the department will send notification to the local government whether the documentation is complete and correct for the desired base year.

(a) If supporting documentation submitted with the application is deficient, the department will notify the local government and request additional information.

(b) By March 1, the department must receive the local government's complete and corrected documentation to establish a base year effective January 1 of the previous year.

(c) If supporting documentation submitted with the application is complete and correct, the department will notify the local government and will report the base, actual, and incremental taxable values to the taxing jurisdictions by the first Monday in August of the calendar year following receipt of the notification in (2).

(d) If supporting documentation submitted for creation or amendment of a TEDD is not complete and correct, the department will report the base, actual, and incremental taxable values to the taxing jurisdictions by the first Monday in August of the calendar year following the year which the complete and correct supporting documentation is submitted to the department.

(7) All correspondence and documentation must be mailed to the Department of Revenue, Property Assessment Division at P.O. Box 8018, Helena, MT 59604-8018, or e-mailed to DORTIFinfo@mt.gov.

| 42.19.1405 | NEW TECHNOLOGY TAX INCREMENT FINANCING DISTRICTS – INFORMATION REQUIRED TO ENABLE THE DEPARTMENT TO CERTIFY BASE TAXABLE VALUE |

This rule has been repealed.

| 42.19.1406 | NEW AEROSPACE TRANSPORTATION AND TECHNOLOGY TAX INCREMENT FINANCING DISTRICTS – INFORMATION REQUIRED TO ENABLE THE DEPARTMENT TO CERTIFY BASE TAXABLE VALUE |

This rule has been repealed.

| 42.19.1407 | DETERMINATION OF BASE AND INCREMENTAL TAXABLE VALUES OF URBAN RENEWAL DISTRICTS (URD) OR TARGETED ECONOMIC DEVELOPMENT DISTRICTS (TEDD) |

(1) The department will determine the:

(a) base taxable value for a URD or TEDD as the taxable value of all property located within the district, exclusive of any Title 15, chapter 24, MCA, locally approved abatement reductions, as of January 1 of the base year established in accordance with ARM 42.19.1403(6) and 42.19.1404(6); and

(b) incremental taxable value by subtracting the base taxable value identified in (1)(a) from the total taxable value of all property within the district.

(2) The incremental value of a district cannot be less than zero.

(3) The department will report the base, actual, and incremental taxable values to all affected taxing jurisdictions by the first Monday of August each year when the department certifies values pursuant to 15-10-202, MCA.

(4) A URD or TEDD may include one or more levy districts. If a URD or TEDD includes more than one levy district, the department will apportion the base taxable value and the incremental taxable value between the levy districts by apportioning the base taxable value and the incremental taxable value to each levy district according to its contribution to the total taxable value of the URD or TEDD.

(5) A local government that amends the boundaries or makes changes within a valid URD or TEDD, pursuant to the provisions of Title 7, chapter 15, parts 42 and 43, MCA, shall follow the process described in ARM 42.19.1403 or 42.19.1404.

(a) In cases where a boundary amendment removes property from an existing URD or TEDD:

(i) the removed property shall be considered newly taxable pursuant to 15-10-420, MCA;

(ii) the base year of the original URD or TEDD will not change;

(iii) the total value of the URD or TEDD will be reduced by the value of the property that has been removed from the district. The value of the property being removed will be the value determined by the department for ad valorem tax purposes as of January 1 of the year in which the department certifies the amendment; and

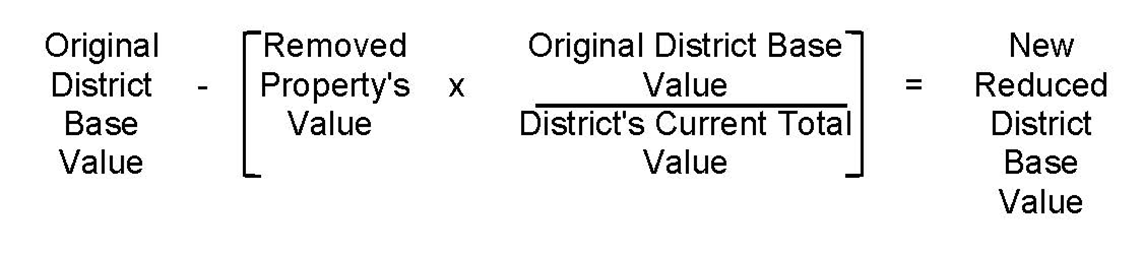

(iv) The reduced base value of the URD or TEDD will be determined by the following formula:

(b) In cases where a URD or TEDD boundary amendment adds new property to an existing URD or TEDD:

(i) the base year and base taxable value of the properties located within the original URD or TEDD will not change;

(ii) the base taxable value of the property being added to the URD or TEDD by the boundary amendment will be the actual taxable value determined by the department for ad valorem tax purposes as of January 1 of the year in which the department certifies the amendment;

(iii) the base taxable value calculated pursuant to (ii) of the property being added to the URD or TEDD will be added to the existing base taxable value of the URD or TEDD to create the new base taxable value that shall be used to calculate the incremental taxable value of the URD or TEDD; and

(iv) the incremental value of the URD or TEDD after the boundary amendment will be calculated using the new base taxable value determined in (iii).

| 42.19.1408 | DETERMINATION AND REPORT OF BASE YEAR, ACTUAL, AND INCREMENTAL TAXABLE VALUES – TIMING |

This rule has been repealed.

| 42.19.1409 | NOTIFICATION OF AMENDMENT OF BOUNDARIES OR CHANGES WITHIN AN EXISTING TAX INCREMENT FINANCE DISTRICT - NEWLY TAXABLE PROPERTY |

This rule has been repealed.

| 42.19.1410 | INFORMATION REQUIRED BY THE DEPARTMENT TO CERTIFY BASE YEAR TAXABLE VALUES OF AN AMENDED OR CHANGED TAX INCREMENT FINANCING DISTRICT (TIFD) |

This rule has been repealed.

| 42.19.1411 | DETERMINATION OF BASE YEAR TAXABLE VALUES OF AN AMENDED TIFD – REPORTING OF BASE YEAR, ACTUAL, AND INCREMENTAL TAXABLE VALUES |

This rule has been repealed.

| 42.19.1412 | LOCAL GOVERNMENT REPORTING REQUIREMENTS |

(1) No later than October 1 of each year, the local government must provide the department with a copy of each bond resolution or ordinance required under 7-15-4301, MCA, and on a form provided by the department, must report the following information:

(a) contact for the district;

(b) year the district expires;

(c) details on any bonds secured by the tax increment, if applicable, including the:

(i) dollar amount of the bond(s) issued;

(ii) term of year on the bond(s) issued; and

(iii) retirement of any bond(s);

(d) details on remittance agreements including:

(i) whether the district has a remittance agreement;

(ii) the names of the agreements; and

(iii) the dollar amount remitted; and

(e) a description of changes or amendments, if any, made to the district in the previous fiscal year.

(2) All correspondence and documentation must be mailed to the Department of Revenue, Property Assessment Division at P.O. Box 8018, Helena, MT 59604-8018 or e-mailed to DORTIFinfo@mt.gov.